president & cfo - UB Group

president & cfo - UB Group

president & cfo - UB Group

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

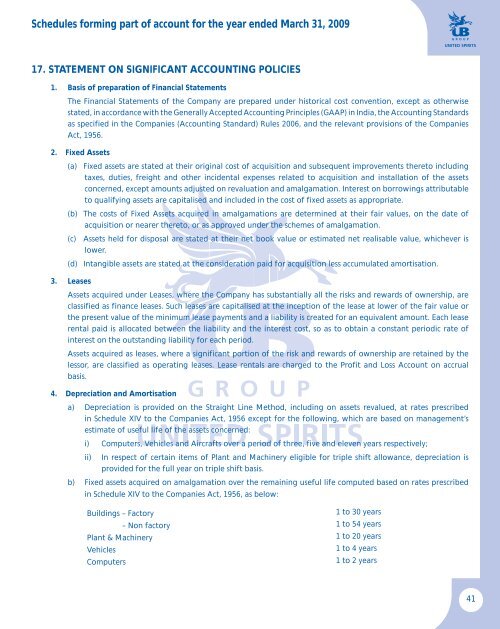

Schedules forming part of account for the year ended March 31, 200917. STATEMENT ON SIGNIFICANT ACCOUNTING POLICIES1. Basis of preparation of Financial StatementsThe Financial Statements of the Company are prepared under historical cost convention, except as otherwisestated, in accordance with the Generally Accepted Accounting Principles (GAAP) in India, the Accounting Standardsas specified in the Companies (Accounting Standard) Rules 2006, and the relevant provisions of the CompaniesAct, 1956.2. Fixed Assets(a) Fixed assets are stated at their original cost of acquisition and subsequent improvements thereto includingtaxes, duties, freight and other incidental expenses related to acquisition and installation of the assetsconcerned, except amounts adjusted on revaluation and amalgamation. Interest on borrowings attributableto qualifying assets are capitalised and included in the cost of fixed assets as appropriate.(b) The costs of Fixed Assets acquired in amalgamations are determined at their fair values, on the date ofacquisition or nearer thereto, or as approved under the schemes of amalgamation.(c) Assets held for disposal are stated at their net book value or estimated net realisable value, whichever islower.(d) Intangible assets are stated at the consideration paid for acquisition less accumulated amortisation.3. LeasesAssets acquired under Leases, where the Company has substantially all the risks and rewards of ownership, areclassified as finance leases. Such leases are capitalised at the inception of the lease at lower of the fair value orthe present value of the minimum lease payments and a liability is created for an equivalent amount. Each leaserental paid is allocated between the liability and the interest cost, so as to obtain a constant periodic rate ofinterest on the outstanding liability for each period.Assets acquired as leases, where a significant portion of the risk and rewards of ownership are retained by thelessor, are classified as operating leases. Lease rentals are charged to the Profit and Loss Account on accrualbasis.4. Depreciation and Amortisationa) Depreciation is provided on the Straight Line Method, including on assets revalued, at rates prescribedin Schedule XIV to the Companies Act, 1956 except for the following, which are based on management’sestimate of useful life of the assets concerned:i) Computers, Vehicles and Aircrafts over a period of three, five and eleven years respectively;ii) In respect of certain items of Plant and Machinery eligible for triple shift allowance, depreciation isprovided for the full year on triple shift basis.b) Fixed assets acquired on amalgamation over the remaining useful life computed based on rates prescribedin Schedule XIV to the Companies Act, 1956, as below:Buildings – Factory1 to 30 years– Non factory 1 to 54 yearsPlant & Machinery1 to 20 yearsVehicles1 to 4 yearsComputers1 to 2 years41