Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

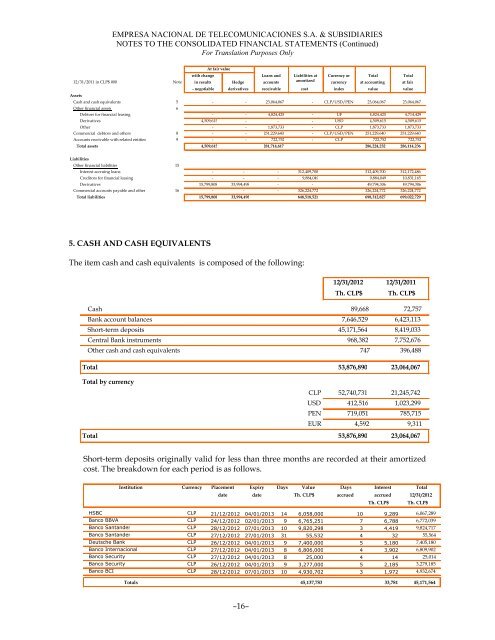

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Translation Purposes OnlyAt fair valuewith change Loans and Liabilities at Currency or Total Total12/31/2011 in CLP$ 000 Note in results Hedge accountsamortizedcurrency at accounting at fair- negotiable derivatives receivable costindex value valueAssetsCash and cash equivalents 5 - - 23,064,067 - CLP/USD/PEN 23,064,067 23,064,067Other financial assets 6Debtors for financial leasing - - 4,824,425 - UF 4,824,425 4,714,429Derivatives 4,509,615 - - - USD 4,509,615 4,509,615Other - - 1,873,733 - CLP 1,873,733 1,873,733Commercial debtors and others 8 - - 251,229,640 - CLP/USD/PEN 251,229,640 251,229,640Accounts receivable with related entities 9 - - 722,752 - CLP 722,752 722,752Total assets 4,509,615 281,714,617 286,224,232 286,114,236LiabilitiesOther financial liabilities 15Interest accruing loans - - - 312,409,700 312,409,700 312,172,486Creditors for financial leasing - - - 9,884,049 9,884,049 10,831,165Derivatives 15,799,808 33,994,498 - - 49,794,306 49,794,306Commercial accounts payable and other 16 - - - 326,224,772 326,224,772 326,224,772Total liabilities 15,799,808 33,994,498 648,518,521 698,312,827 699,022,7295. CASH AND CASH EQUIVALENTSThe item cash and cash equivalents is composed of the following:12/31/2012 12/31/2011Th. CLP$ Th. CLP$Cash 89,668 72,757Bank account balances 7,646,529 6,423,113Short-term deposits 45,171,564 8,419,033Central Bank instruments 968,382 7,752,676Other cash and cash equivalents 747 396,488Total 53,876,890 23,064,067Total by currencyCLP 52,740,731 21,245,742USD 412,516 1,023,299PEN 719,051 785,715EUR 4,592 9,311Total 53,876,890 23,064,067Short-term deposits originally valid for less than three months are recorded at their amortizedcost. The breakdown for each period is as follows.Institution Currency Placement Expiry Days Value Days Interest Totaldate date Th. CLP$ accrued accrued 12/31/2012Th. CLP$Th. CLP$HSBC CLP 21/12/2012 04/01/2013 14 6,058,000 10 9,289 6,067,289Banco BBVA CLP 24/12/2012 02/01/2013 9 6,765,251 7 6,788 6,772,039Banco Santander CLP 28/12/2012 07/01/2013 10 9,820,298 3 4,419 9,824,717Banco Santander CLP 27/12/2012 27/01/2013 31 55,532 4 32 55,564Deutsche Bank CLP 26/12/2012 04/01/2013 9 7,400,000 5 5,180 7,405,180Banco Internacional CLP 27/12/2012 04/01/2013 8 6,806,000 4 3,902 6,809,902Banco Security CLP 27/12/2012 04/01/2013 8 25,000 4 14 25,014Banco Security CLP 26/12/2012 04/01/2013 9 3,277,000 5 2,185 3,279,185Banco BCI CLP 28/12/2012 07/01/2013 10 4,930,702 3 1,972 4,932,674Totals 45,137,783 33,781 45,171,564–16–