Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

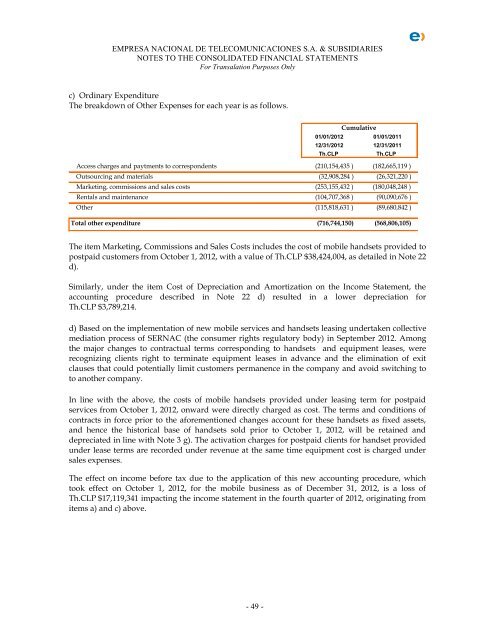

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor Transalation Purposes Onlyc) Ordinary ExpenditureThe breakdown of Other Expenses for each year is as follows.Cumulative01/01/2012 01/01/201112/31/2012 12/31/2011Th.CLPTh.CLPAccess charges and paytments to correspondents (210,154,435 ) (182,665,119 )Outsourcing and materials (32,908,284 ) (26,321,220 )Marketing, commissions and sales costs (253,155,432 ) (180,048,248 )Rentals and maintenance (104,707,368 ) (90,090,676 )Other (115,818,631 ) (89,680,842 )Total other expenditure (716,744,150) (568,806,105)The item Marketing, Commissions and Sales Costs includes the cost of mobile handsets provided topostpaid customers from October 1, 2012, with a value of Th.CLP $38,424,004, as detailed in Note 22d).Similarly, under the item Cost of Depreciation and Amortization on the Income Statement, theaccounting procedure described in Note 22 d) resulted in a lower depreciation forTh.CLP $3,789,214.d) Based on the implementation of new mobile services and handsets leasing undertaken collectivemediation process of SERNAC (the consumer rights regulatory body) in September 2012. Amongthe major changes to contractual terms corresponding to handsets and equipment leases, wererecognizing clients right to terminate equipment leases in advance and the elimination of exitclauses that could potentially limit customers permanence in the company and avoid switching toto another company.In line with the above, the costs of mobile handsets provided under leasing term for postpaidservices from October 1, 2012, onward were directly charged as cost. The terms and conditions ofcontracts in force prior to the aforementioned changes account for these handsets as fixed assets,and hence the historical base of handsets sold prior to October 1, 2012, will be retained anddepreciated in line with Note 3 g). The activation charges for postpaid clients for handset providedunder lease terms are recorded under revenue at the same time equipment cost is charged undersales expenses.The effect on income before tax due to the application of this new accounting procedure, whichtook effect on October 1, 2012, for the mobile business as of December 31, 2012, is a loss ofTh.CLP $17,119,341 impacting the income statement in the fourth quarter of 2012, originating fromitems a) and c) above.- 49 -