Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

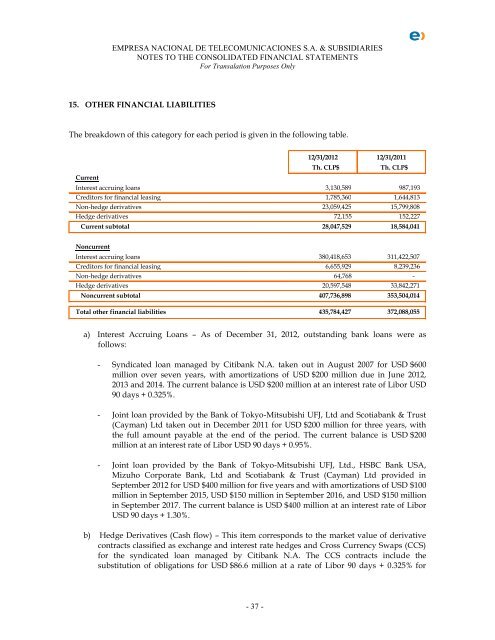

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor Transalation Purposes Only15. OTHER FINANCIAL LIABILITIESThe breakdown of this category for each period is given in the following table.12/31/2012 12/31/2011Th. CLP$Th. CLP$CurrentInterest accruing loans 3,130,589 987,193Creditors for financial leasing 1,785,360 1,644,813Non-hedge derivatives 23,059,425 15,799,808Hedge derivatives 72,155 152,227Current subtotal 28,047,529 18,584,041NoncurrentInterest accruing loans 380,418,653 311,422,507Creditors for financial leasing 6,655,929 8,239,236Non-hedge derivatives 64,768 -Hedge derivatives 20,597,548 33,842,271Noncurrent subtotal 407,736,898 353,504,014Total other financial liabilities 435,784,427 372,088,055a) Interest Accruing Loans – As of December 31, 2012, outstanding bank loans were asfollows:- Syndicated loan managed by Citibank N.A. taken out in August 2007 for USD $600million over seven years, with amortizations of USD $200 million due in June 2012,2013 and 2014. The current balance is USD $200 million at an interest rate of Libor USD90 days + 0.325%.- Joint loan provided by the Bank of Tokyo-Mitsubishi UFJ, Ltd and Scotiabank & Trust(Cayman) Ltd taken out in December 2011 for USD $200 million for three years, withthe full amount payable at the end of the period. The current balance is USD $200million at an interest rate of Libor USD 90 days + 0.95%.- Joint loan provided by the Bank of Tokyo-Mitsubishi UFJ, Ltd., HSBC Bank USA,Mizuho Corporate Bank, Ltd and Scotiabank & Trust (Cayman) Ltd provided inSeptember 2012 for USD $400 million for five years and with amortizations of USD $100million in September 2015, USD $150 million in September 2016, and USD $150 millionin September 2017. The current balance is USD $400 million at an interest rate of LiborUSD 90 days + 1.30%.b) Hedge Derivatives (Cash flow) – This item corresponds to the market value of derivativecontracts classified as exchange and interest rate hedges and Cross Currency Swaps (CCS)for the syndicated loan managed by Citibank N.A. The CCS contracts include thesubstitution of obligations for USD $86.6 million at a rate of Libor 90 days + 0.325% for- 37 -