Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

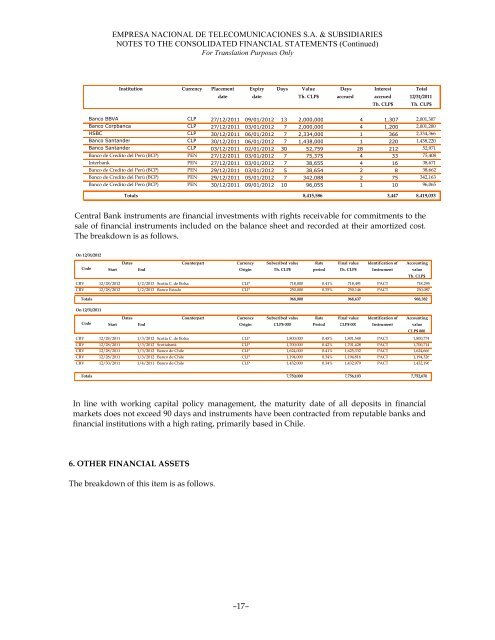

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Translation Purposes OnlyInstitution Currency Placement Expiry Days Value Days Interest Totaldate date Th. CLP$ accrued accrued 12/31/2011Th. CLP$ Th. CLP$Banco BBVA CLP 27/12/2011 09/01/2012 13 2,000,000 4 1,307 2,001,307Banco Corpbanca CLP 27/12/2011 03/01/2012 7 2,000,000 4 1,200 2,001,200HSBC CLP 30/12/2011 06/01/2012 7 2,334,000 1 366 2,334,366Banco Santander CLP 30/12/2011 06/01/2012 7 1,438,000 1 220 1,438,220Banco Santander CLP 03/12/2011 02/01/2012 30 52,759 28 212 52,971Banco de Credito del Perú (BCP) PEN 27/12/2011 03/01/2012 7 75,375 4 33 75,408Interbank PEN 27/12/2011 03/01/2012 7 38,655 4 16 38,671Banco de Credito del Perú (BCP) PEN 29/12/2011 03/01/2012 5 38,654 2 8 38,662Banco de Credito del Perú (BCP) PEN 29/12/2011 05/01/2012 7 342,088 2 75 342,163Banco de Credito del Perú (BCP) PEN 30/12/2011 09/01/2012 10 96,055 1 10 96,065Totals 8,415,586 3,447 8,419,033Central Bank instruments are financial investments with rights receivable for commitments to thesale of financial instruments included on the balance sheet and recorded at their amortized cost.The breakdown is as follows.On 12/31/2012CodeDatesStart EndCounterpart CurrencyOriginSubscribed valueTh. CLP$RateperiodFinal valueTh. CLP$Identification ofInstrumentAccountingvalueTh. CLP$CRVCRV12/28/201212/28/20121/2/2013 Scotia C. de Bolsa1/2/2013 Banco EstadoCLPCLP718,000250,0000.41%0.35%718,491250,146PACTPACT718,295250,087Totals 968,000 968,637 968,382On 12/31/2011CodeDatesCounterpart Currency Subscribed value Rate Final value Identification of AccountingStart End Origin CLP$ 000 Period CLP$ 000 Instrument valueCRV 12/28/2011 1/3/2012 Scotia C. de Bolsa CLP 1,800,000 0.45% 1,801,548 PACT 1,800,774CRV 12/28/2011 1/3/2012 Scotiabank CLP 1,700,000 0.42% 1,701,428 PACT 1,700,714CRV 12/28/2011 1/3/2012 Banco de Chile CLP 1,624,000 0.41% 1,625,332 PACT 1,624,666CRV 12/28/2011 1/3/2012 Banco de Chile CLP 1,194,000 0.34% 1,194,816 PACT 1,194,326CRV 12/30/2011 1/4/2011 Banco de Chile CLP 1,432,000 0.34% 1,432,979 PACT 1,432,196CLP$ 000Totals 7,750,000 7,756,103 7,752,676In line with working capital policy management, the maturity date of all deposits in financialmarkets does not exceed 90 days and instruments have been contracted from reputable banks andfinancial institutions with a high rating, primarily based in Chile.6. OTHER FINANCIAL ASSETSThe breakdown of this item is as follows.–17–