Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

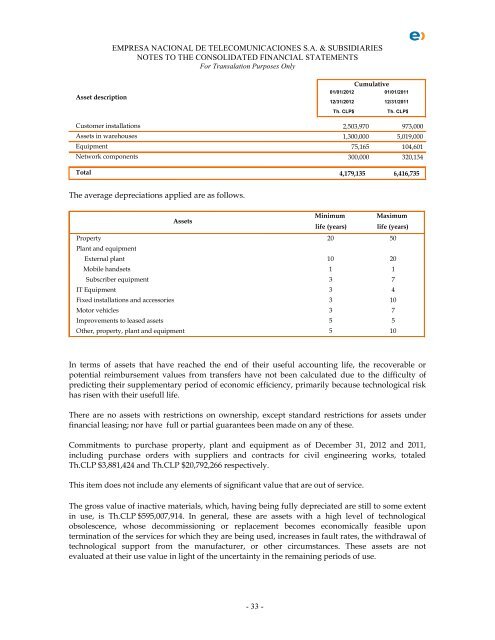

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor Transalation Purposes OnlyAsset descriptionCumulative01/01/2012 01/01/201112/31/2012 12/31/2011Th. CLP$Th. CLP$Customer installations 2,503,970 973,000Assets in warehouses 1,300,000 5,019,000Equipment 75,165 104,601Network components 300,000 320,134Total 4,179,135 6,416,735The average depreciations applied are as follows.AssetsMinimumlife (years)Maximumlife (years)Property 20 50Plant and equipmentExternal plant 10 20Mobile handsets 1 1Subscriber equipment 3 7IT Equipment 3 4Fixed installations and accessories 3 10Motor vehicles 3 7Improvements to leased assets 5 5Other, property, plant and equipment 5 10In terms of assets that have reached the end of their useful accounting life, the recoverable orpotential reimbursement values from transfers have not been calculated due to the difficulty ofpredicting their supplementary period of economic efficiency, primarily because technological riskhas risen with their usefull life.There are no assets with restrictions on ownership, except standard restrictions for assets underfinancial leasing; nor have full or partial guarantees been made on any of these.Commitments to purchase property, plant and equipment as of December 31, 2012 and 2011,including purchase orders with suppliers and contracts for civil engineering works, totaledTh.CLP $3,881,424 and Th.CLP $20,792,266 respectively.This item does not include any elements of significant value that are out of service.The gross value of inactive materials, which, having being fully depreciated are still to some extentin use, is Th.CLP $595,007,914. In general, these are assets with a high level of technologicalobsolescence, whose decommissioning or replacement becomes economically feasible upontermination of the services for which they are being used, increases in fault rates, the withdrawal oftechnological support from the manufacturer, or other circumstances. These assets are notevaluated at their use value in light of the uncertainty in the remaining periods of use.- 33 -