Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

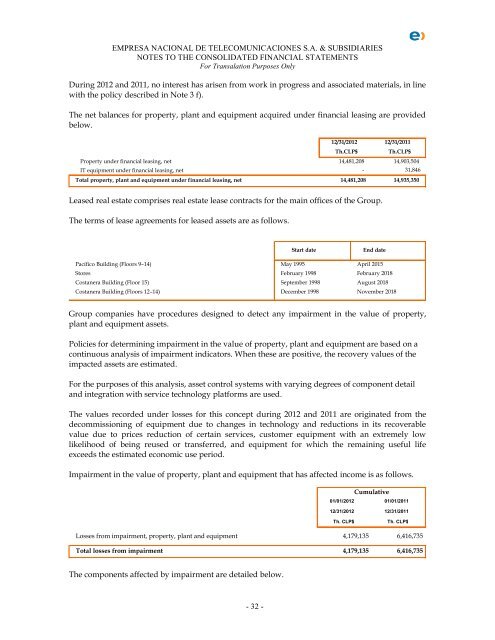

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor Transalation Purposes OnlyDuring 2012 and 2011, no interest has arisen from work in progress and associated materials, in linewith the policy described in Note 3 f).The net balances for property, plant and equipment acquired under financial leasing are providedbelow.12/31/2012 12/31/2011Th.CLP$Th.CLP$Property under financial leasing, net 14,481,208 14,903,504IT equipment under financial leasing, net - 31,846Total property, plant and equipment under financial leasing, net 14,481,208 14,935,350Leased real estate comprises real estate lease contracts for the main offices of the Group.The terms of lease agreements for leased assets are as follows.Start dateEnd datePacífico Building (Floors 9–14) May 1995 April 2015Stores February 1998 February 2018Costanera Building (Floor 15) September 1998 August 2018Costanera Building (Floors 12–14) December 1998 November 2018Group companies have procedures designed to detect any impairment in the value of property,plant and equipment assets.Policies for determining impairment in the value of property, plant and equipment are based on acontinuous analysis of impairment indicators. When these are positive, the recovery values of theimpacted assets are estimated.For the purposes of this analysis, asset control systems with varying degrees of component detailand integration with service technology platforms are used.The values recorded under losses for this concept during 2012 and 2011 are originated from thedecommissioning of equipment due to changes in technology and reductions in its recoverablevalue due to prices reduction of certain services, customer equipment with an extremely lowlikelihood of being reused or transferred, and equipment for which the remaining useful lifeexceeds the estimated economic use period.Impairment in the value of property, plant and equipment that has affected income is as follows.Cumulative01/01/2012 01/01/201112/31/2012 12/31/2011Th. CLP$Th. CLP$Losses from impairment, property, plant and equipment 4,179,135 6,416,735Total losses from impairment 4,179,135 6,416,735The components affected by impairment are detailed below.- 32 -