Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

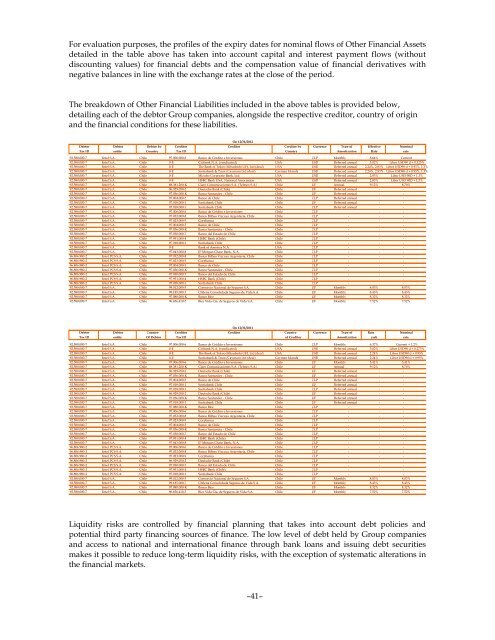

For evaluation purposes, the profiles of the expiry dates for nominal flows of Other <strong>Financial</strong> Assetsdetailed in the table above has taken into account capital and interest payment flows (withoutdiscounting values) for financial debts and the compensation value of financial derivatives withnegative balances in line with the exchange rates at the close of the period.The breakdown of Other <strong>Financial</strong> Liabilities included in the above tables is provided below,detailing each of the debtor Group companies, alongside the respective creditor, country of originand the financial conditions for these liabilities.On 12/31/2012Debtor Debtor Debtor by Creditor Creditor Creditor by Currency Type of Effective NominalTax ID entity Country Tax ID Country Amortization Rate rate92.580.000-7 <strong>Entel</strong> S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile CLP Monthly 8.64% Current92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Citibank N.A. (syndicated) USA USD Deferred annual 5.02% Libor USD90 d + 0.325%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E The Bank of Tokyo-Mitsubishi UFJ, Ltd (deal) USA USD Deferred annual 2.24%, 2.83% Libor USD90 d + 0.95%, 1.3%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Scotiabank & Trust (Cayman) Ltd (deal) Cayman Islands USD Deferred annual 2.24%, 2.83% Libor USD90 d + 0.95%, 1.3%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Mizuho Corporate Bank, Ltd. USA USD Deferred annual 2.83% Libor USD 90D + 1.3%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E HSBC Bank USA, National Association USA USD Deferred annual 2.83% Libor USD 90D + 1.3%92.580.000-7 <strong>Entel</strong> S.A. Chile 88.381.200-K Claro Comunicaciones S.A. (Telmex S.A.) Chile UF Annual 9.12% 8.70%92.580.000-7 <strong>Entel</strong> S.A. Chile 96.929.050-2 Deutsche Bank (Chile) Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.036.000-K Banco Santander - Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.004.000-5 Banco de Chile Chile CLP Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile CLP Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile CLP - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.032.000-8 Banco Bilbao Vizcaya Argentaria, Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.023.000-9 Corpbanca Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.004.000-5 Banco de Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.036.000-K Banco Santander - Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.030.000-7 Banco del Estado de Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.951.000-4 HSBC Bank (Chile) Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Bank of America N.A. USA CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.043.000-8 JP Morgan Chase Bank, N.A. Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.032.000-8 Banco Bilbao Vizcaya Argentaria, Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.023.000-9 Corpbanca Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.004.000-5 Banco de Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.036.000-K Banco Santander - Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.030.000-7 Banco del Estado de Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.951.000-4 HSBC Bank (Chile) Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.018.000-1 Scotiabank Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 99.012.000-5 Consorcio Nacional de Seguros S.A. Chile UF Monthly 8.03% 8.03%92.580.000-7 <strong>Entel</strong> S.A. Chile 99.185.000-7 Chilena Consolidada Seguros de Vida S.A. Chile UF Monthly 8.43% 8.43%92.580.000-7 <strong>Entel</strong> S.A. Chile 97.080.000-K Banco Bice Chile UF Monthly 8.32% 8.32%92.580.000-7 <strong>Entel</strong> S.A. Chile 96.656.410-5 Bice Vida Cía. de Seguros de Vida S.A. Chile UF Monthly 7.52% 7.52%On 12/31/2011Debtor Debtor Country Creditor Creditor Country Currency Type of Rate NominalTax ID entity Of Debtor Tax ID of Creditor Amortization cash rate92.580.000-7 <strong>Entel</strong> S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile CLP Monthly 6.37% Current + 1.2%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Citibank N.A. (syndicated) USA USD Deferred annual 5.02% Libor USD90 d + 0.275%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E The Bank of Tokyo-Mitsubishi UFJ, Ltd (deal) USA USD Deferred annual 2.24% Libor USD90 d + 0.95%92.580.000-7 <strong>Entel</strong> S.A. Chile 0-E Scotiabank & Trust (Cayman) Ltd (deal) Cayman Islands USD Deferred annual 2.24% Libor USD90 d + 0.95%92.580.000-7 <strong>Entel</strong> S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile UF Monthly 5.41% 5.41%92.580.000-7 <strong>Entel</strong> S.A. Chile 88.381.200-K Claro Comunicaciones S.A. (Telmex S.A.) Chile UF Annual 9.12% 8.70%92.580.000-7 <strong>Entel</strong> S.A. Chile 96.929.050-2 Deutsche Bank (Chile) Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.036.000-K Banco Santander - Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.004.000-5 Banco de Chile Chile CLP Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile CLP Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 96.929.050-2 Deutsche Bank (Chile) Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.036.000-K Banco Santander - Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.018.000-1 Scotiabank Chile Chile UF Deferred annual - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.080.000-K Banco Bice Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.032.000-8 Banco Bilbao Vizcaya Argentaria, Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.023.000-9 Corpbanca Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.004.000-5 Banco de Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.036.000-K Banco Santander - Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.030.000-7 Banco del Estado de Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.951.000-4 HSBC Bank (Chile) Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 97.043.000-8 JP Morgan Chase Bank, N.A. Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.006.000-6 Banco de Crédito e Inversiones Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.032.000-8 Banco Bilbao Vizcaya Argentaria, Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.023.000-9 Corpbanca Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 96.929.050-2 Deutsche Bank (Chile) Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.030.000-7 Banco del Estado de Chile Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.951.000-4 HSBC Bank (Chile) Chile CLP - - -96.806.980-2 <strong>Entel</strong> PCS S.A. Chile 97.018.000-1 Scotiabank Chile Chile CLP - - -92.580.000-7 <strong>Entel</strong> S.A. Chile 99.012.000-5 Consorcio Nacional de Seguros S.A. Chile UF Monthly 8.03% 8.03%92.580.000-7 <strong>Entel</strong> S.A. Chile 99.185.000-7 Chilena Consolidada Seguros de Vida S.A. Chile UF Monthly 8.43% 8.43%92.580.000-7 <strong>Entel</strong> S.A. Chile 97.080.000-K Banco Bice Chile UF Monthly 8.32% 8.32%92.580.000-7 <strong>Entel</strong> S.A. Chile 96.656.410-5 Bice Vida Cía. de Seguros de Vida S.A. Chile UF Monthly 7.52% 7.52%Liquidity risks are controlled by financial planning that takes into account debt policies andpotential third party financing sources of finance. The low level of debt held by Group companiesand access to national and international finance through bank loans and issuing debt securitiesmakes it possible to reduce long-term liquidity risks, with the exception of systematic alterations inthe financial markets.–41–