Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

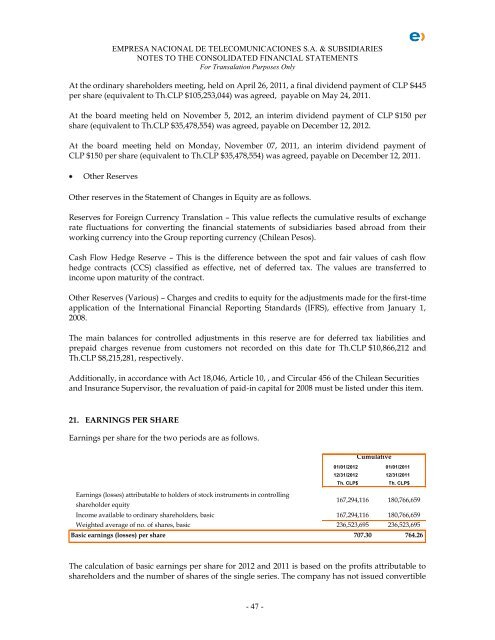

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTSFor Transalation Purposes OnlyAt the ordinary shareholders meeting, held on April 26, 2011, a final dividend payment of CLP $445per share (equivalent to Th.CLP $105,253,044) was agreed, payable on May 24, 2011.At the board meeting held on November 5, 2012, an interim dividend payment of CLP $150 pershare (equivalent to Th.CLP $35,478,554) was agreed, payable on December 12, 2012.At the board meeting held on Monday, November 07, 2011, an interim dividend payment ofCLP $150 per share (equivalent to Th.CLP $35,478,554) was agreed, payable on December 12, 2011.Other ReservesOther reserves in the Statement of Changes in Equity are as follows.Reserves for Foreign Currency Translation – This value reflects the cumulative results of exchangerate fluctuations for converting the financial statements of subsidiaries based abroad from theirworking currency into the Group reporting currency (Chilean Pesos).Cash Flow Hedge Reserve – This is the difference between the spot and fair values of cash flowhedge contracts (CCS) classified as effective, net of deferred tax. The values are transferred toincome upon maturity of the contract.Other Reserves (Various) – Charges and credits to equity for the adjustments made for the first-timeapplication of the International <strong>Financial</strong> Reporting Standards (IFRS), effective from January 1,2008.The main balances for controlled adjustments in this reserve are for deferred tax liabilities andprepaid charges revenue from customers not recorded on this date for Th.CLP $10,866,212 andTh.CLP $8,215,281, respectively.Additionally, in accordance with Act 18,046, Article 10, , and Circular 456 of the Chilean Securitiesand Insurance Supervisor, the revaluation of paid-in capital for 2008 must be listed under this item.21. EARNINGS PER SHAREEarnings per share for the two periods are as follows.Cumulative01/01/2012 01/01/201112/31/2012 12/31/2011Th. CLP$Th. CLP$Earnings (losses) attributable to holders of stock instruments in controllingshareholder equity167,294,116 180,766,659Income available to ordinary shareholders, basic 167,294,116 180,766,659Weighted average of no. of shares, basic 236,523,695 236,523,695Basic earnings (losses) per share 707.30 764.26The calculation of basic earnings per share for 2012 and 2011 is based on the profits attributable toshareholders and the number of shares of the single series. The company has not issued convertible- 47 -