Financial Statements - Entel

Financial Statements - Entel

Financial Statements - Entel

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

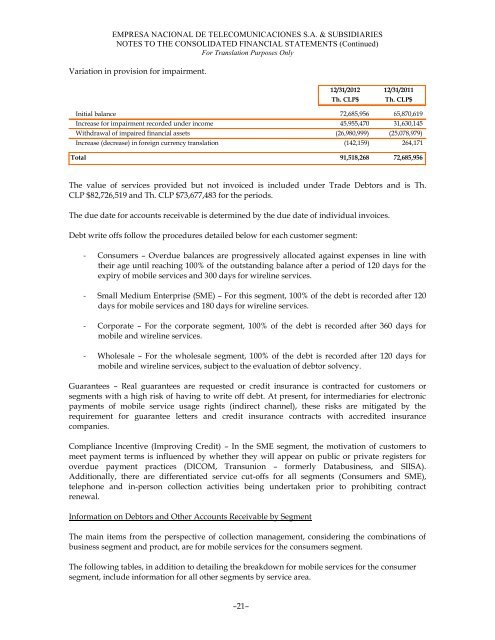

EMPRESA NACIONAL DE TELECOMUNICACIONES S.A. & SUBSIDIARIESNOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS (Continued)For Translation Purposes OnlyVariation in provision for impairment.12/31/2012 12/31/2011Th. CLP$ Th. CLP$Initial balance 72,685,956 65,870,619Increase for impairment recorded under income 45,955,470 31,630,145Withdrawal of impaired financial assets (26,980,999) (25,078,979)Increase (decrease) in foreign currency translation (142,159) 264,171Total 91,518,268 72,685,956The value of services provided but not invoiced is included under Trade Debtors and is Th.CLP $82,726,519 and Th. CLP $73,677,483 for the periods.The due date for accounts receivable is determined by the due date of individual invoices.Debt write offs follow the procedures detailed below for each customer segment:- Consumers – Overdue balances are progressively allocated against expenses in line withtheir age until reaching 100% of the outstanding balance after a period of 120 days for theexpiry of mobile services and 300 days for wireline services.- Small Medium Enterprise (SME) – For this segment, 100% of the debt is recorded after 120days for mobile services and 180 days for wireline services.- Corporate – For the corporate segment, 100% of the debt is recorded after 360 days formobile and wireline services.- Wholesale – For the wholesale segment, 100% of the debt is recorded after 120 days formobile and wireline services, subject to the evaluation of debtor solvency.Guarantees – Real guarantees are requested or credit insurance is contracted for customers orsegments with a high risk of having to write off debt. At present, for intermediaries for electronicpayments of mobile service usage rights (indirect channel), these risks are mitigated by therequirement for guarantee letters and credit insurance contracts with accredited insurancecompanies.Compliance Incentive (Improving Credit) – In the SME segment, the motivation of customers tomeet payment terms is influenced by whether they will appear on public or private registers foroverdue payment practices (DICOM, Transunion – formerly Databusiness, and SIISA).Additionally, there are differentiated service cut-offs for all segments (Consumers and SME),telephone and in-person collection activities being undertaken prior to prohibiting contractrenewal.Information on Debtors and Other Accounts Receivable by SegmentThe main items from the perspective of collection management, considering the combinations ofbusiness segment and product, are for mobile services for the consumers segment.The following tables, in addition to detailing the breakdown for mobile services for the consumersegment, include information for all other segments by service area.–21–