federal register - U.S. Government Printing Office

federal register - U.S. Government Printing Office

federal register - U.S. Government Printing Office

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

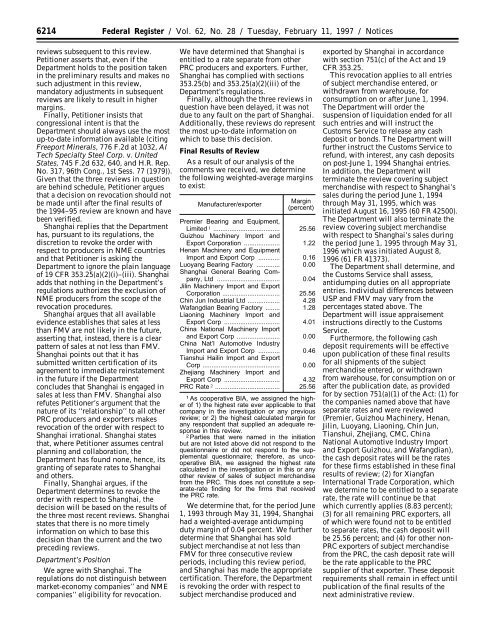

6214 Federal Register / Vol. 62, No. 28 / Tuesday, February 11, 1997 / Noticesreviews subsequent to this review.Petitioner asserts that, even if theDepartment holds to the position takenin the preliminary results and makes nosuch adjustment in this review,mandatory adjustments in subsequentreviews are likely to result in highermargins.Finally, Petitioner insists thatcongressional intent is that theDepartment should always use the mostup-to-date information available (citingFreeport Minerals, 776 F.2d at 1032, AlTech Specialty Steel Corp. v. UnitedStates, 745 F.2d 632, 640, and H.R. Rep.No. 317, 96th Cong., 1st Sess. 77 (1979)).Given that the three reviews in questionare behind schedule, Petitioner arguesthat a decision on revocation should notbe made until after the final results ofthe 1994–95 review are known and havebeen verified.Shanghai replies that the Departmenthas, pursuant to its regulations, thediscretion to revoke the order withrespect to producers in NME countriesand that Petitioner is asking theDepartment to ignore the plain languageof 19 CFR 353.25(a)(2)(i)–(iii). Shanghaiadds that nothing in the Department’sregulations authorizes the exclusion ofNME producers from the scope of therevocation procedures.Shanghai argues that all availableevidence establishes that sales at lessthan FMV are not likely in the future,asserting that, instead, there is a clearpattern of sales at not less than FMV.Shanghai points out that it hassubmitted written certification of itsagreement to immediate reinstatementin the future if the Departmentconcludes that Shanghai is engaged insales at less than FMV. Shanghai alsorefutes Petitioner’s argument that thenature of its ‘‘relationship’’ to all otherPRC producers and exporters makesrevocation of the order with respect toShanghai irrational. Shanghai statesthat, where Petitioner assumes centralplanning and collaboration, theDepartment has found none, hence, itsgranting of separate rates to Shanghaiand others.Finally, Shanghai argues, if theDepartment determines to revoke theorder with respect to Shanghai, thedecision will be based on the results ofthe three most recent reviews. Shanghaistates that there is no more timelyinformation on which to base thisdecision than the current and the twopreceding reviews.Department’s PositionWe agree with Shanghai. Theregulations do not distinguish betweenmarket-economy companies’’ and NMEcompanies’’ eligibility for revocation.We have determined that Shanghai isentitled to a rate separate from otherPRC producers and exporters. Further,Shanghai has complied with sections353.25(b) and 353.25(a)(2)(iii) of theDepartment’s regulations.Finally, although the three reviews inquestion have been delayed, it was notdue to any fault on the part of Shanghai.Additionally, these reviews do representthe most up-to-date information onwhich to base this decision.Final Results of ReviewAs a result of our analysis of thecomments we received, we determinethe following weighted-average marginsto exist:Manufacturer/exporterMargin(percent)Premier Bearing and Equipment,Limited 1 ..................................... 25.56Guizhou Machinery Import andExport Corporation .................... 1.22Henan Machinery and EquipmentImport and Export Corp ............ 0.16Luoyang Bearing Factory ............. 0.00Shanghai General Bearing Company,Ltd ................................... 0.04Jilin Machinery Import and ExportCorporation ................................ 25.56Chin Jun Industrial Ltd .................. 4.28Wafangdian Bearing Factory ........ 1.28Liaoning Machinery Import andExport Corp ............................... 4.01China National Machinery Importand Export Corp ........................ 0.00China Nat’l Automotive IndustryImport and Export Corp ............ 0.46Tianshui Hailin Import and ExportCorp ........................................... 0.00Zhejiang Machinery Import andExport Corp ............................... 4.32PRC Rate 2 .................................... 25.561 As cooperative BIA, we assigned the higherof 1) the highest rate ever applicable to thatcompany in the investigation or any previousreview; or 2) the highest calculated margin forany respondent that supplied an adequate responsein this review.2 Parties that were named in the initiationbut are not listed above did not respond to thequestionnaire or did not respond to the supplementalquestionnaire; therefore, as uncooperativeBIA, we assigned the highest ratecalculated in the investigation or in this or anyother review of sales of subject merchandisefrom the PRC. This does not constitute a separate-ratefinding for the firms that receivedthe PRC rate.We determine that, for the period June1, 1993 through May 31, 1994, Shanghaihad a weighted-average antidumpingduty margin of 0.04 percent. We furtherdetermine that Shanghai has soldsubject merchandise at not less thanFMV for three consecutive reviewperiods, including this review period,and Shanghai has made the appropriatecertification. Therefore, the Departmentis revoking the order with respect tosubject merchandise produced andexported by Shanghai in accordancewith section 751(c) of the Act and 19CFR 353.25.This revocation applies to all entriesof subject merchandise entered, orwithdrawn from warehouse, forconsumption on or after June 1, 1994.The Department will order thesuspension of liquidation ended for allsuch entries and will instruct theCustoms Service to release any cashdeposit or bonds. The Department willfurther instruct the Customs Service torefund, with interest, any cash depositson post-June 1, 1994 Shanghai entries.In addition, the Department willterminate the review covering subjectmerchandise with respect to Shanghai’ssales during the period June 1, 1994through May 31, 1995, which wasinitiated August 16, 1995 (60 FR 42500).The Department will also terminate thereview covering subject merchandisewith respect to Shanghai’s sales duringthe period June 1, 1995 through May 31,1996 which was initiated August 8,1996 (61 FR 41373).The Department shall determine, andthe Customs Service shall assess,antidumping duties on all appropriateentries. Individual differences betweenUSP and FMV may vary from thepercentages stated above. TheDepartment will issue appraisementinstructions directly to the CustomsService.Furthermore, the following cashdeposit requirements will be effectiveupon publication of these final resultsfor all shipments of the subjectmerchandise entered, or withdrawnfrom warehouse, for consumption on orafter the publication date, as providedfor by section 751(a)(1) of the Act: (1) forthe companies named above that haveseparate rates and were reviewed(Premier, Guizhou Machinery, Henan,Jilin, Luoyang, Liaoning, Chin Jun,Tianshui, Zhejiang, CMC, ChinaNational Automotive Industry Importand Export Guizhou, and Wafangdian),the cash deposit rates will be the ratesfor these firms established in these finalresults of review; (2) for XiangfanInternational Trade Corporation, whichwe determine to be entitled to a separaterate, the rate will continue be thatwhich currently applies (8.83 percent);(3) for all remaining PRC exporters, allof which were found not to be entitledto separate rates, the cash deposit willbe 25.56 percent; and (4) for other non-PRC exporters of subject merchandisefrom the PRC, the cash deposit rate willbe the rate applicable to the PRCsupplier of that exporter. These depositrequirements shall remain in effect untilpublication of the final results of thenext administrative review.