GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

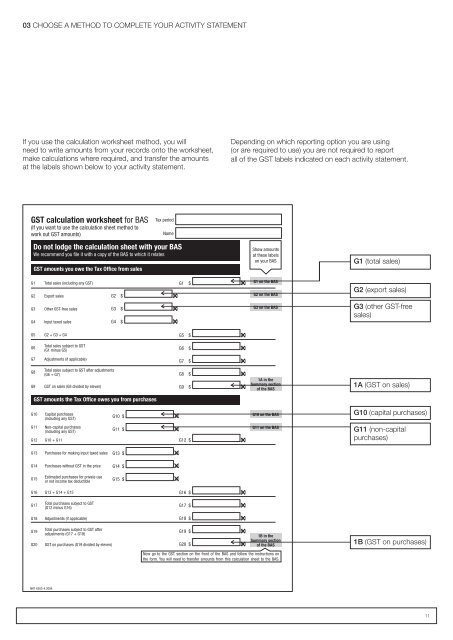

03 CHOOSE A METHOD TO COMPLETE YOUR ACTIVITY STATEMENTIf you use the calculation worksheet method, you willneed to write amounts from <strong>your</strong> records onto the worksheet,make calculations where required, and transfer the amountsat the labels shown below to <strong>your</strong> <strong>activity</strong> <strong>statement</strong>.Depending on which reporting option you are using(or are required to use) you are not required to reportall of the <strong>GST</strong> labels indicated on each <strong>activity</strong> <strong>statement</strong>.<strong>GST</strong> calculation worksheet for BAS(If you want to use the calculation sheet method towork out <strong>GST</strong> amounts)Do not lodge the calculation sheet with <strong>your</strong> BASWe recommend you file it with a copy of the BAS to which it relates<strong>GST</strong> amounts you owe the Tax <strong>Office</strong> from salesTax periodNameShow amountsat these labelson <strong>your</strong> BASG1 (total sales)G1G2Total sales (including any <strong>GST</strong>)Export salesG1 $ .00G2 $ .00G1 on the BASG2 on the BASG2 (export sales)G3G4Other <strong>GST</strong>-free salesInput taxed salesG3 $ .00G4 $ .00G3 on the BASG3 (other <strong>GST</strong>‐freesales)G5G2 + G3 + G4G5 $ .00G6Total sales subject to <strong>GST</strong>(G1 minus G5)G6 $ .00G7Adjustments (if applicable)G7 $ .00G8G9Total sales subject to <strong>GST</strong> after adjustments(G6 + G7)<strong>GST</strong> on sales (G8 divided by eleven)G8 $ .00G9 $ .001A in theSummary sectionof the BAS1A (<strong>GST</strong> on sales)<strong>GST</strong> amounts the Tax <strong>Office</strong> owes you from purchasesG10Capital purchases(including any <strong>GST</strong>)G10 $ .00G10 on the BASG10 (capital purchases)G11G12Non-capital purchases(including any <strong>GST</strong>)G10 + G11G11 $ .00G12 $ .00G11 on the BASG11 (non-capitalpurchases)G13Purchases for making input taxed salesG13 $ .00G14Purchases without <strong>GST</strong> in the priceG14 $ .00G15Estimated purchases for private useor not income tax deductibleG15 $ .00G16G13 + G14 + G15G16 $ .00G17Total purchases subject to <strong>GST</strong>(G12 minus G16)G17 $ .00G18Adjustments (if applicable)G18 $ .00G19G20Total purchases subject to <strong>GST</strong> afteradjustments (G17 + G18)<strong>GST</strong> on purchases (G19 divided by eleven)G19 $ .00G20 $ .001B in theSummary sectionof the BAS1B (<strong>GST</strong> on purchases)Now go to the <strong>GST</strong> section on the front of the BAS and follow the instructions onthe form. You will need to transfer amounts from this calculation sheet to the BAS.NAT 4203-4.200411