GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

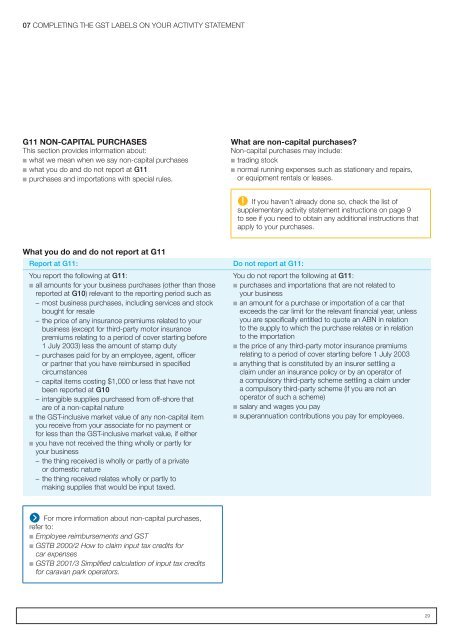

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTG11 NON-CAPITAL PURCHASESThis section provides information about:n what we mean when we say non-capital purchasesn what you do and do not report at G11n purchases and importations with special rules.What are non-capital purchases?Non-capital purchases may include:n trading stockn normal running expenses such as stationery and repairs,or equipment rentals or leases.If you haven’t already done so, check the list ofsupplementary <strong>activity</strong> <strong>statement</strong> instructions on page 9to see if you need to obtain any additional instructions thatapply to <strong>your</strong> purchases.What you do and do not report at G11Report at G11: Do not report at G11:You report the following at G11:n all amounts for <strong>your</strong> business purchases (other than thosereported at G10) relevant to the reporting period such as<strong>–</strong><strong>–</strong>most business purchases, including services and stockbought for resale<strong>–</strong><strong>–</strong>the price of any insurance premiums related to <strong>your</strong>business (except for third-party motor insurancepremiums relating to a period of cover starting before1 July 2003) less the amount of stamp duty<strong>–</strong><strong>–</strong>purchases paid for by an employee, agent, officeror partner that you have reimbursed in specifiedcircumstances<strong>–</strong><strong>–</strong>capital items costing $1,000 or less that have notbeen reported at G10<strong>–</strong><strong>–</strong>intangible supplies purchased from off-shore thatare of a non-capital naturen the <strong>GST</strong>-inclusive market value of any non-capital itemyou receive from <strong>your</strong> associate for no payment orfor less than the <strong>GST</strong>-inclusive market value, if eithern you have not received the thing wholly or partly for<strong>your</strong> business<strong>–</strong><strong>–</strong>the thing received is wholly or partly of a privateor domestic nature<strong>–</strong><strong>–</strong>the thing received relates wholly or partly tomaking supplies that would be input taxed.You do not report the following at G11:n purchases and importations that are not related to<strong>your</strong> businessn an amount for a purchase or importation of a car thatexceeds the car limit for the relevant financial year, unlessyou are specifically entitled to quote an ABN in relationto the supply to which the purchase relates or in relationto the importationn the price of any third-party motor insurance premiumsrelating to a period of cover starting before 1 July 2003n anything that is constituted by an insurer settling aclaim under an insurance policy or by an operator ofa compulsory third-party scheme settling a claim undera compulsory third-party scheme (if you are not anoperator of such a scheme)n salary and wages you payn superannuation contributions you pay for employees.For more information about non-capital purchases,refer to:n Employee reimbursements and <strong>GST</strong>n <strong>GST</strong>B 2000/2 How to claim input tax credits forcar expensesn <strong>GST</strong>B 2001/3 Simplified calculation of input tax creditsfor caravan park operators.29