GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

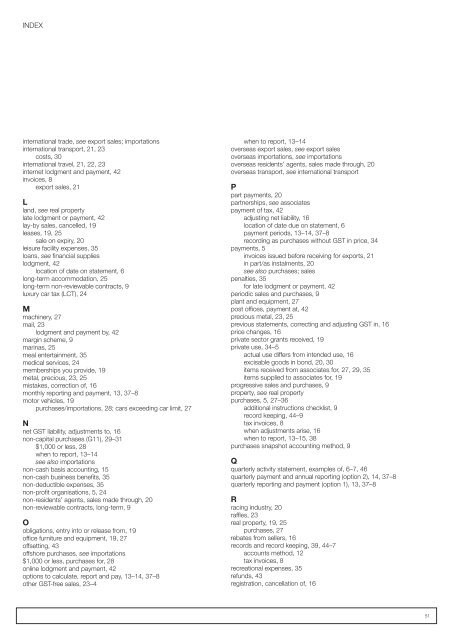

INDEXinternational trade, see export sales; importationsinternational transport, 21, 23costs, 30international travel, 21, 22, 23internet lodgment and payment, 42invoices, 8export sales, 21Lland, see real propertylate lodgment or payment, 42lay-by sales, cancelled, 19leases, 19, 25sale on expiry, 20leisure facility expenses, 35loans, see financial supplieslodgment, 42location of date on <strong>statement</strong>, 6long-term accommodation, 25long-term non-reviewable contracts, 9luxury car tax (LCT), 24Mmachinery, 27mail, 23lodgment and payment by, 42margin scheme, 9marinas, 25meal entertainment, 35medical services, 24memberships you provide, 19metal, precious, 23, 25mistakes, correction of, 16monthly reporting and payment, 13, 37<strong>–</strong>8motor vehicles, 19purchases/importations, 28; cars exceeding car limit, 27Nnet <strong>GST</strong> liability, adjustments to, 16non-capital purchases (G11), 29<strong>–</strong>31$1,000 or less, 28when to report, 13<strong>–</strong>14see also importationsnon-cash basis accounting, 15non-cash business benefits, 35non-deductible expenses, 35non-profit organisations, 5, 24non-residents’ agents, sales made through, 20non-reviewable contracts, long-term, 9Oobligations, entry into or release from, 19office furniture and equipment, 19, 27offsetting, 43offshore purchases, see importations$1,000 or less, purchases for, 28online lodgment and payment, 42options to calculate, report and pay, 13<strong>–</strong>14, 37<strong>–</strong>8other <strong>GST</strong>-free sales, 23<strong>–</strong>4when to report, 13<strong>–</strong>14overseas export sales, see export salesoverseas importations, see importationsoverseas residents’ agents, sales made through, 20overseas transport, see international transportPpart payments, 20partnerships, see associatespayment of tax, 42adjusting net liability, 16location of date due on <strong>statement</strong>, 6payment periods, 13<strong>–</strong>14, 37<strong>–</strong>8recording as purchases without <strong>GST</strong> in price, 34payments, 5invoices issued before receiving for exports, 21in part/as instalments, 20see also purchases; salespenalties, 35for late lodgment or payment, 42periodic sales and purchases, 9plant and equipment, 27post offices, payment at, 42precious metal, 23, 25previous <strong>statement</strong>s, correcting and adjusting <strong>GST</strong> in, 16price changes, 16private sector grants received, 19private use, 34<strong>–</strong>5actual use differs from intended use, 16excisable goods in bond, 20, 30items received from associates for, 27, 29, 35items supplied to associates for, 19progressive sales and purchases, 9property, see real propertypurchases, 5, 27<strong>–</strong>36additional instructions checklist, 9record keeping, 44<strong>–</strong>9tax invoices, 8when adjustments arise, 16when to report, 13<strong>–</strong>15, 38purchases snapshot accounting method, 9Qquarterly <strong>activity</strong> <strong>statement</strong>, examples of, 6<strong>–</strong>7, 46quarterly payment and annual reporting (option 2), 14, 37<strong>–</strong>8quarterly reporting and payment (option 1), 13, 37<strong>–</strong>8Rracing industry, 20raffles, 23real property, 19, 25purchases, 27rebates from sellers, 16records and record keeping, 39, 44<strong>–</strong>7accounts method, 12tax invoices, 8recreational expenses, 35refunds, 43registration, cancellation of, 1651