GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

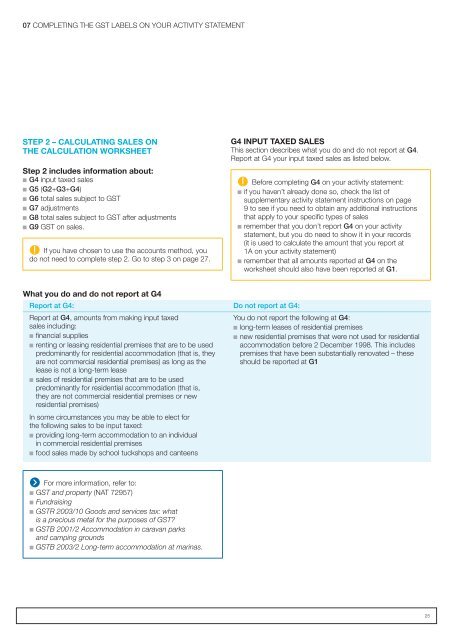

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTSTEP 2 <strong>–</strong> CALCULATING SALES ONTHE CALCULATION WORKSHEETStep 2 includes information about:n G4 input taxed salesn G5 (G2+G3+G4)n G6 total sales subject to <strong>GST</strong>n G7 adjustmentsn G8 total sales subject to <strong>GST</strong> after adjustmentsn G9 <strong>GST</strong> on sales.If you have chosen to use the accounts method, youdo not need to complete step 2. Go to step 3 on page 27.G4 INPUT TAXED SALESThis section describes what you do and do not report at G4.Report at G4 <strong>your</strong> input taxed sales as listed below.Before <strong>completing</strong> G4 on <strong>your</strong> <strong>activity</strong> <strong>statement</strong>:n if you haven’t already done so, check the list ofsupplementary <strong>activity</strong> <strong>statement</strong> instructions on page9 to see if you need to obtain any additional instructionsthat apply to <strong>your</strong> specific types of salesn remember that you don’t report G4 on <strong>your</strong> <strong>activity</strong><strong>statement</strong>, but you do need to show it in <strong>your</strong> records(it is used to calculate the amount that you report at1A on <strong>your</strong> <strong>activity</strong> <strong>statement</strong>)n remember that all amounts reported at G4 on theworksheet should also have been reported at G1.What you do and do not report at G4Report at G4: Do not report at G4:Report at G4, amounts from making input taxedsales including:n financial suppliesn renting or leasing residential premises that are to be usedpredominantly for residential accommodation (that is, theyare not commercial residential premises) as long as thelease is not a long-term leasen sales of residential premises that are to be usedpredominantly for residential accommodation (that is,they are not commercial residential premises or newresidential premises)In some circumstances you may be able to elect forthe following sales to be input taxed:n providing long-term accommodation to an individualin commercial residential premisesn food sales made by school tuckshops and canteensYou do not report the following at G4:n long-term leases of residential premisesn new residential premises that were not used for residentialaccommodation before 2 December 1998. This includespremises that have been substantially renovated <strong>–</strong> theseshould be reported at G1For more information, refer to:n <strong>GST</strong> and property (NAT 72957)n Fundraisingn <strong>GST</strong>R 2003/10 Goods and services tax: whatis a precious metal for the purposes of <strong>GST</strong>?n <strong>GST</strong>B 2001/2 Accommodation in caravan parksand camping groundsn <strong>GST</strong>B 2003/2 Long-term accommodation at marinas.25