GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

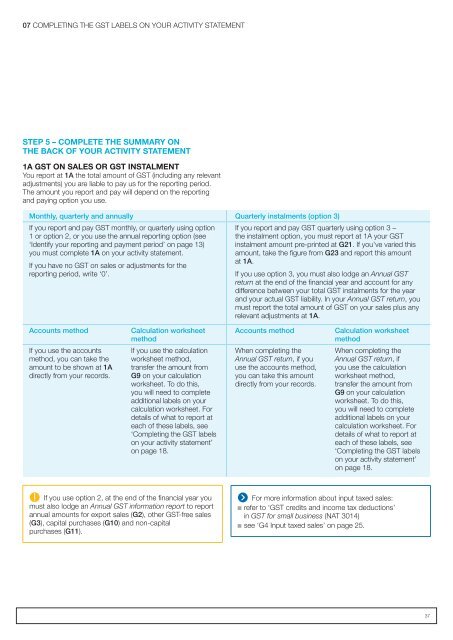

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTSTEP 5 <strong>–</strong> COMPLETE THE SUMMARY ONTHE BACK OF YOUR ACTIVITY STATEMENT1A <strong>GST</strong> ON SALES OR <strong>GST</strong> INSTALMENTYou report at 1A the total amount of <strong>GST</strong> (including any relevantadjustments) you are liable to pay us for the reporting period.The amount you report and pay will depend on the reportingand paying option you use.Monthly, quarterly and annually Quarterly instalments (option 3)If you report and pay <strong>GST</strong> monthly, or quarterly using option1 or option 2, or you use the annual reporting option (see‘Identify <strong>your</strong> reporting and payment period’ on page 13)you must complete 1A on <strong>your</strong> <strong>activity</strong> <strong>statement</strong>.If you have no <strong>GST</strong> on sales or adjustments for thereporting period, write ‘0’.If you report and pay <strong>GST</strong> quarterly using option 3 <strong>–</strong>the instalment option, you must report at 1A <strong>your</strong> <strong>GST</strong>instalment amount pre-printed at G21. If you’ve varied thisamount, take the figure from G23 and report this amountat 1A.If you use option 3, you must also lodge an Annual <strong>GST</strong>return at the end of the financial year and account for anydifference between <strong>your</strong> total <strong>GST</strong> instalments for the yearand <strong>your</strong> actual <strong>GST</strong> liability. In <strong>your</strong> Annual <strong>GST</strong> return, youmust report the total amount of <strong>GST</strong> on <strong>your</strong> sales plus anyrelevant adjustments at 1A.Accounts methodIf you use the accountsmethod, you can take theamount to be shown at 1Adirectly from <strong>your</strong> records.Calculation worksheetmethodIf you use the calculationworksheet method,transfer the amount fromG9 on <strong>your</strong> calculationworksheet. To do this,you will need to completeadditional labels on <strong>your</strong>calculation worksheet. Fordetails of what to report ateach of these labels, see‘Completing the <strong>GST</strong> labelson <strong>your</strong> <strong>activity</strong> <strong>statement</strong>’on page 18.Accounts methodWhen <strong>completing</strong> theAnnual <strong>GST</strong> return, if youuse the accounts method,you can take this amountdirectly from <strong>your</strong> records.Calculation worksheetmethodWhen <strong>completing</strong> theAnnual <strong>GST</strong> return, ifyou use the calculationworksheet method,transfer the amount fromG9 on <strong>your</strong> calculationworksheet. To do this,you will need to completeadditional labels on <strong>your</strong>calculation worksheet. Fordetails of what to report ateach of these labels, see‘Completing the <strong>GST</strong> labelson <strong>your</strong> <strong>activity</strong> <strong>statement</strong>’on page 18.If you use option 2, at the end of the financial year youmust also lodge an Annual <strong>GST</strong> information report to reportannual amounts for export sales (G2), other <strong>GST</strong>‐free sales(G3), capital purchases (G10) and non‐capitalpurchases (G11).For more information about input taxed sales:n refer to ‘<strong>GST</strong> credits and income tax deductions’in <strong>GST</strong> for small business (NAT 3014)n see ‘G4 Input taxed sales’ on page 25.37