GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

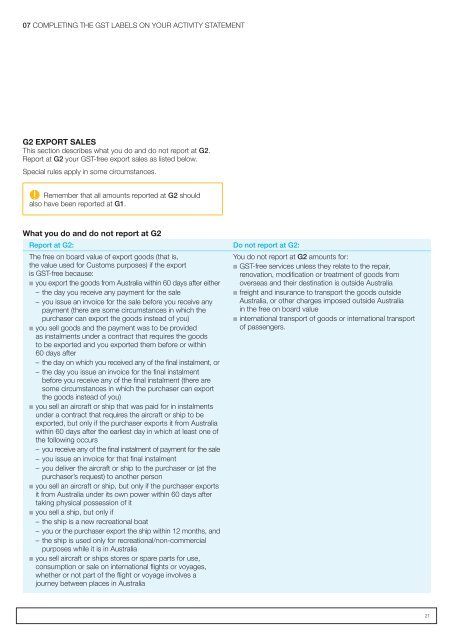

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTG2 EXPORT SALESThis section describes what you do and do not report at G2.Report at G2 <strong>your</strong> <strong>GST</strong>‐free export sales as listed below.Special rules apply in some circumstances.Remember that all amounts reported at G2 shouldalso have been reported at G1.What you do and do not report at G2Report at G2: Do not report at G2:The free on board value of export goods (that is,the value used for Customs purposes) if the exportis <strong>GST</strong>‐free because:n you export the goods from Australia within 60 days after either<strong>–</strong><strong>–</strong>the day you receive any payment for the sale<strong>–</strong><strong>–</strong>you issue an invoice for the sale before you receive anypayment (there are some circumstances in which thepurchaser can export the goods instead of you)n you sell goods and the payment was to be providedas instalments under a contract that requires the goodsto be exported and you exported them before or within60 days after<strong>–</strong><strong>–</strong>the day on which you received any of the final instalment, or<strong>–</strong><strong>–</strong>the day you issue an invoice for the final instalmentbefore you receive any of the final instalment (there aresome circumstances in which the purchaser can exportthe goods instead of you)n you sell an aircraft or ship that was paid for in instalmentsunder a contract that requires the aircraft or ship to beexported, but only if the purchaser exports it from Australiawithin 60 days after the earliest day in which at least one ofthe following occurs<strong>–</strong><strong>–</strong>you receive any of the final instalment of payment for the sale<strong>–</strong><strong>–</strong>you issue an invoice for that final instalment<strong>–</strong><strong>–</strong>you deliver the aircraft or ship to the purchaser or (at thepurchaser’s request) to another personn you sell an aircraft or ship, but only if the purchaser exportsit from Australia under its own power within 60 days aftertaking physical possession of itn you sell a ship, but only if<strong>–</strong><strong>–</strong>the ship is a new recreational boat<strong>–</strong><strong>–</strong>you or the purchaser export the ship within 12 months, and<strong>–</strong><strong>–</strong>the ship is used only for recreational/non-commercialpurposes while it is in <strong>Australian</strong> you sell aircraft or ships stores or spare parts for use,consumption or sale on international flights or voyages,whether or not part of the flight or voyage involves ajourney between places in AustraliaYou do not report at G2 amounts for:n <strong>GST</strong>-free services unless they relate to the repair,renovation, modification or treatment of goods fromoverseas and their destination is outside <strong>Australian</strong> freight and insurance to transport the goods outsideAustralia, or other charges imposed outside Australiain the free on board valuen international transport of goods or international transportof passengers.21