GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

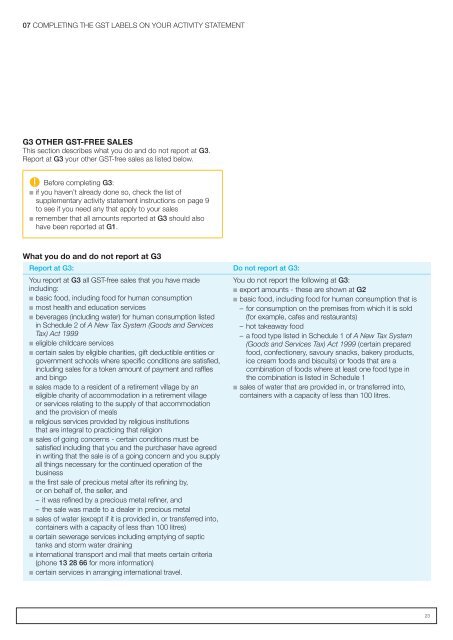

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTG3 OTHER <strong>GST</strong>-FREE SALESThis section describes what you do and do not report at G3.Report at G3 <strong>your</strong> other <strong>GST</strong>-free sales as listed below.Before <strong>completing</strong> G3:n if you haven’t already done so, check the list ofsupplementary <strong>activity</strong> <strong>statement</strong> instructions on page 9to see if you need any that apply to <strong>your</strong> salesn remember that all amounts reported at G3 should alsohave been reported at G1.What you do and do not report at G3Report at G3: Do not report at G3:You report at G3 all <strong>GST</strong>-free sales that you have madeincluding:n basic food, including food for human consumptionn most health and education servicesn beverages (including water) for human consumption listedin Schedule 2 of A New Tax System (Goods and ServicesTax) Act 1999n eligible childcare servicesn certain sales by eligible charities, gift deductible entities orgovernment schools where specific conditions are satisfied,including sales for a token amount of payment and rafflesand bingon sales made to a resident of a retirement village by aneligible charity of accommodation in a retirement villageor services relating to the supply of that accommodationand the provision of mealsn religious services provided by religious institutionsthat are integral to practicing that religionn sales of going concerns - certain conditions must besatisfied including that you and the purchaser have agreedin writing that the sale is of a going concern and you supplyall things necessary for the continued operation of thebusinessn the first sale of precious metal after its refining by,or on behalf of, the seller, and<strong>–</strong><strong>–</strong>it was refined by a precious metal refiner, and<strong>–</strong><strong>–</strong>the sale was made to a dealer in precious metaln sales of water (except if it is provided in, or transferred into,containers with a capacity of less than 100 litres)n certain sewerage services including emptying of septictanks and storm water drainingn international transport and mail that meets certain criteria(phone 13 28 66 for more information)n certain services in arranging international travel.You do not report the following at G3:n export amounts - these are shown at G2n basic food, including food for human consumption that is<strong>–</strong><strong>–</strong>for consumption on the premises from which it is sold(for example, cafes and restaurants)<strong>–</strong><strong>–</strong>hot takeaway food<strong>–</strong><strong>–</strong>a food type listed in Schedule 1 of A New Tax System(Goods and Services Tax) Act 1999 (certain preparedfood, confectionery, savoury snacks, bakery products,ice cream foods and biscuits) or foods that are acombination of foods where at least one food type inthe combination is listed in Schedule 1n sales of water that are provided in, or transferred into,containers with a capacity of less than 100 litres.23