GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

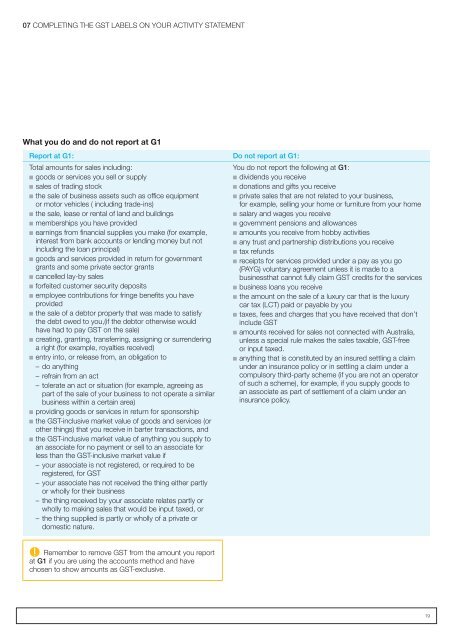

07 COMPLETING THE <strong>GST</strong> LABELS ON YOUR ACTIVITY STATEMENTWhat you do and do not report at G1Report at G1: Do not report at G1:Total amounts for sales including:n goods or services you sell or supplyn sales of trading stockn the sale of business assets such as office equipmentor motor vehicles ( including trade-ins)n the sale, lease or rental of land and buildingsn memberships you have providedn earnings from financial supplies you make (for example,interest from bank accounts or lending money but notincluding the loan principal)n goods and services provided in return for governmentgrants and some private sector grantsn cancelled lay-by salesn forfeited customer security depositsn employee contributions for fringe benefits you haveprovidedn the sale of a debtor property that was made to satisfythe debt owed to you,(if the debtor otherwise wouldhave had to pay <strong>GST</strong> on the sale)n creating, granting, transferring, assigning or surrenderinga right (for example, royalties received)n entry into, or release from, an obligation to<strong>–</strong><strong>–</strong>do anything<strong>–</strong><strong>–</strong>refrain from an act<strong>–</strong><strong>–</strong>tolerate an act or situation (for example, agreeing aspart of the sale of <strong>your</strong> business to not operate a similarbusiness within a certain area)n providing goods or services in return for sponsorshipn the <strong>GST</strong>-inclusive market value of goods and services (orother things) that you receive in barter transactions, andn the <strong>GST</strong>-inclusive market value of anything you supply toan associate for no payment or sell to an associate forless than the <strong>GST</strong>-inclusive market value if<strong>–</strong><strong>–</strong><strong>your</strong> associate is not registered, or required to beregistered, for <strong>GST</strong><strong>–</strong><strong>–</strong><strong>your</strong> associate has not received the thing either partlyor wholly for their business<strong>–</strong><strong>–</strong>the thing received by <strong>your</strong> associate relates partly orwholly to making sales that would be input taxed, or<strong>–</strong><strong>–</strong>the thing supplied is partly or wholly of a private ordomestic nature.You do not report the following at G1:n dividends you receiven donations and gifts you receiven private sales that are not related to <strong>your</strong> business,for example, selling <strong>your</strong> home or furniture from <strong>your</strong> homen salary and wages you receiven government pensions and allowancesn amounts you receive from hobby activitiesn any trust and partnership distributions you receiven tax refundsn receipts for services provided under a pay as you go(PAYG) voluntary agreement unless it is made to abusinessthat cannot fully claim <strong>GST</strong> credits for the servicesn business loans you receiven the amount on the sale of a luxury car that is the luxurycar tax (LCT) paid or payable by youn taxes, fees and charges that you have received that don’tinclude <strong>GST</strong>n amounts received for sales not connected with Australia,unless a special rule makes the sales taxable, <strong>GST</strong>-freeor input taxed.n anything that is constituted by an insured settling a claimunder an insurance policy or in settling a claim under acompulsory third-party scheme (if you are not an operatorof such a scheme), for example, if you supply goods toan associate as part of settlement of a claim under aninsurance policy.Remember to remove <strong>GST</strong> from the amount you reportat G1 if you are using the accounts method and havechosen to show amounts as <strong>GST</strong>-exclusive.19