GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

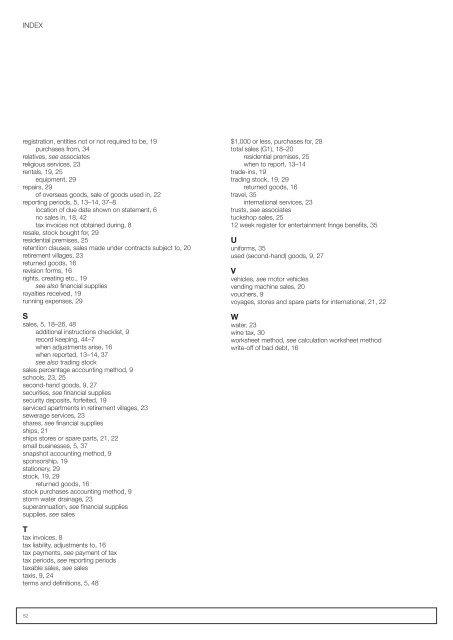

INDEXregistration, entities not or not required to be, 19purchases from, 34relatives, see associatesreligious services, 23rentals, 19, 25equipment, 29repairs, 29of overseas goods, sale of goods used in, 22reporting periods, 5, 13<strong>–</strong>14, 37<strong>–</strong>8location of due date shown on <strong>statement</strong>, 6no sales in, 18, 42tax invoices not obtained during, 8resale, stock bought for, 29residential premises, 25retention clauses, sales made under contracts subject to, 20retirement villages, 23returned goods, 16revision forms, 16rights, creating etc., 19see also financial suppliesroyalties received, 19running expenses, 29Ssales, 5, 18<strong>–</strong>26, 48additional instructions checklist, 9record keeping, 44<strong>–</strong>7when adjustments arise, 16when reported, 13<strong>–</strong>14, 37see also trading stocksales percentage accounting method, 9schools, 23, 25second-hand goods, 9, 27securities, see financial suppliessecurity deposits, forfeited, 19serviced apartments in retirement villages, 23sewerage services, 23shares, see financial suppliesships, 21ships stores or spare parts, 21, 22small businesses, 5, 37snapshot accounting method, 9sponsorship, 19stationery, 29stock, 19, 29returned goods, 16stock purchases accounting method, 9storm water drainage, 23superannuation, see financial suppliessupplies, see sales$1,000 or less, purchases for, 28total sales (G1), 18<strong>–</strong>20residential premises, 25when to report, 13<strong>–</strong>14trade-ins, 19trading stock, 19, 29returned goods, 16travel, 35international services, 23trusts, see associatestuckshop sales, 2512 week register for entertainment fringe benefits, 35Uuniforms, 35used (second-hand) goods, 9, 27Vvehicles, see motor vehiclesvending machine sales, 20vouchers, 9voyages, stores and spare parts for international, 21, 22Wwater, 23wine tax, 30worksheet method, see calculation worksheet methodwrite-off of bad debt, 16Ttax invoices, 8tax liability, adjustments to, 16tax payments, see payment of taxtax periods, see reporting periodstaxable sales, see salestaxis, 9, 24terms and definitions, 5, 4852