GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

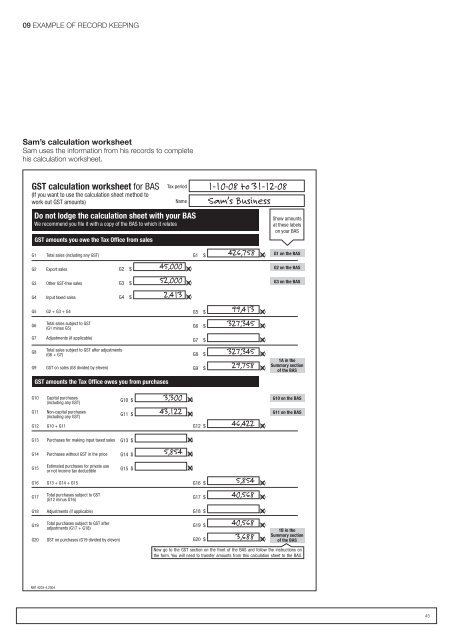

09 EXAMPLE OF RECORD KEEPINGSam’s calculation worksheetSam uses the information from his records to completehis calculation worksheet.<strong>GST</strong> calculation worksheet for BAS(If you want to use the calculation sheet method towork out <strong>GST</strong> amounts)Tax periodName1-10-08 to 31-12-08Sam’s BusinessDo not lodge the calculation sheet with <strong>your</strong> BASWe recommend you file it with a copy of the BAS to which it relatesG1G2G3G4G5G6<strong>GST</strong> amounts you owe the Tax <strong>Office</strong> from salesTotal sales (including any <strong>GST</strong>)Export salesOther <strong>GST</strong>-free salesInput taxed salesG2 + G3 + G4Total sales subject to <strong>GST</strong>(G1 minus G5)45,00052,0002,413G2 $ .00G3 $ .00G4 $ .00426,758G1 $ .0099,413327,345G5 $ .00G6 $ .00Show amountsat these labelson <strong>your</strong> BASG1 on the BASG2 on the BASG3 on the BASG7Adjustments (if applicable)G7 $ .00G8G9Total sales subject to <strong>GST</strong> after adjustments(G6 + G7)<strong>GST</strong> on sales (G8 divided by eleven)327,345G8 $ .0029,758G9 $ .001A in theSummary sectionof the BAS<strong>GST</strong> amounts the Tax <strong>Office</strong> owes you from purchasesG10G11G12Capital purchases(including any <strong>GST</strong>)Non-capital purchases(including any <strong>GST</strong>)G10 + G113,300G10 $ .0043,122G11 $ .0046,422G12 $ .00G10 on the BASG11 on the BASG13Purchases for making input taxed salesG13 $ .00G14Purchases without <strong>GST</strong> in the price5,854G14 $ .00G15G16Estimated purchases for private useor not income tax deductibleG13 + G14 + G15G15 $ .005,854G16 $ .00G17Total purchases subject to <strong>GST</strong>(G12 minus G16)40,568G17 $ .00G18Adjustments (if applicable)G18 $ .00G19G20Total purchases subject to <strong>GST</strong> afteradjustments (G17 + G18)<strong>GST</strong> on purchases (G19 divided by eleven)40,568G19 $ .003,688G20 $ .001B in theSummary sectionof the BASNow go to the <strong>GST</strong> section on the front of the BAS and follow the instructions onthe form. You will need to transfer amounts from this calculation sheet to the BAS.NAT 4203-4.200445