GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

GST – completing your activity statement - Australian Taxation Office

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

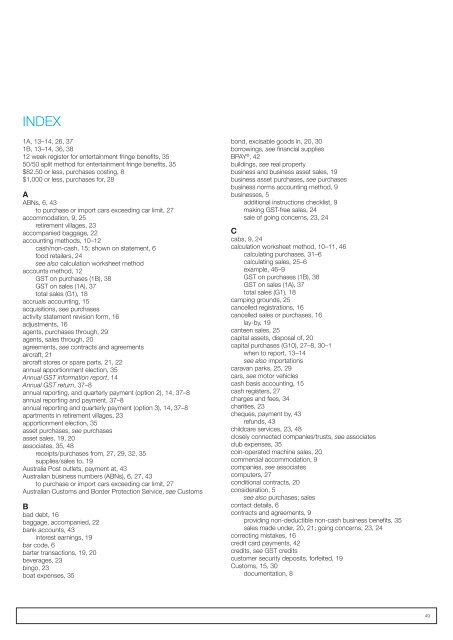

INDEX1A, 13<strong>–</strong>14, 26, 371B, 13<strong>–</strong>14, 36, 3812 week register for entertainment fringe benefits, 3550/50 split method for entertainment fringe benefits, 35$82.50 or less, purchases costing, 8$1,000 or less, purchases for, 28AABNs, 6, 43to purchase or import cars exceeding car limit, 27accommodation, 9, 25retirement villages, 23accompanied baggage, 22accounting methods, 10<strong>–</strong>12cash/non-cash, 15; shown on <strong>statement</strong>, 6food retailers, 24see also calculation worksheet methodaccounts method, 12<strong>GST</strong> on purchases (1B), 38<strong>GST</strong> on sales (1A), 37total sales (G1), 18accruals accounting, 15acquisitions, see purchases<strong>activity</strong> <strong>statement</strong> revision form, 16adjustments, 16agents, purchases through, 29agents, sales through, 20agreements, see contracts and agreementsaircraft, 21aircraft stores or spare parts, 21, 22annual apportionment election, 35Annual <strong>GST</strong> information report, 14Annual <strong>GST</strong> return, 37<strong>–</strong>8annual reporting, and quarterly payment (option 2), 14, 37<strong>–</strong>8annual reporting and payment, 37<strong>–</strong>8annual reporting and quarterly payment (option 3), 14, 37<strong>–</strong>8apartments in retirement villages, 23apportionment election, 35asset purchases, see purchasesasset sales, 19, 20associates, 35, 48receipts/purchases from, 27, 29, 32, 35supplies/sales to, 19Australia Post outlets, payment at, 43<strong>Australian</strong> business numbers (ABNs), 6, 27, 43to purchase or import cars exceeding car limit, 27<strong>Australian</strong> Customs and Border Protection Service, see CustomsBbad debt, 16baggage, accompanied, 22bank accounts, 43interest earnings, 19bar code, 6barter transactions, 19, 20beverages, 23bingo, 23boat expenses, 35bond, excisable goods in, 20, 30borrowings, see financial suppliesBPAY ® , 42buildings, see real propertybusiness and business asset sales, 19business asset purchases, see purchasesbusiness norms accounting method, 9businesses, 5additional instructions checklist, 9making <strong>GST</strong>-free sales, 24sale of going concerns, 23, 24Ccabs, 9, 24calculation worksheet method, 10<strong>–</strong>11, 46calculating purchases, 31<strong>–</strong>6calculating sales, 25<strong>–</strong>6example, 46<strong>–</strong>9<strong>GST</strong> on purchases (1B), 38<strong>GST</strong> on sales (1A), 37total sales (G1), 18camping grounds, 25cancelled registrations, 16cancelled sales or purchases, 16lay-by, 19canteen sales, 25capital assets, disposal of, 20capital purchases (G10), 27<strong>–</strong>8, 30<strong>–</strong>1when to report, 13<strong>–</strong>14see also importationscaravan parks, 25, 29cars, see motor vehiclescash basis accounting, 15cash registers, 27charges and fees, 34charities, 23cheques, payment by, 43refunds, 43childcare services, 23, 48closely connected companies/trusts, see associatesclub expenses, 35coin-operated machine sales, 20commercial accommodation, 9companies, see associatescomputers, 27conditional contracts, 20consideration, 5see also purchases; salescontact details, 6contracts and agreements, 9providing non-deductible non-cash business benefits, 35sales made under, 20, 21; going concerns, 23, 24correcting mistakes, 16credit card payments, 42credits, see <strong>GST</strong> creditscustomer security deposits, forfeited, 19Customs, 15, 30documentation, 849