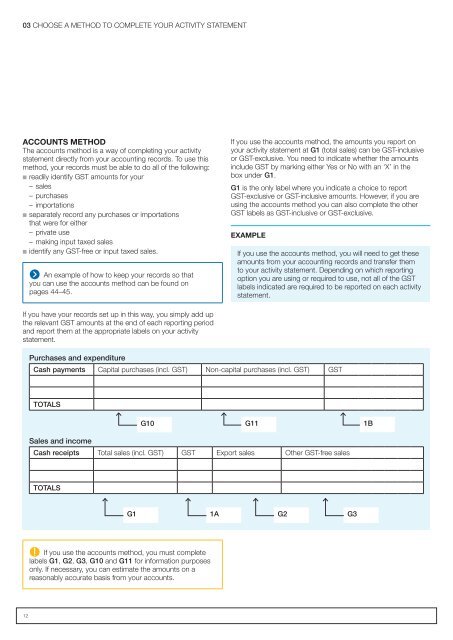

03 CHOOSE A METHOD TO COMPLETE YOUR ACTIVITY STATEMENTACCOUNTS METHODThe accounts method is a way of <strong>completing</strong> <strong>your</strong> <strong>activity</strong><strong>statement</strong> directly from <strong>your</strong> accounting records. To use thismethod, <strong>your</strong> records must be able to do all of the following:n readily identify <strong>GST</strong> amounts for <strong>your</strong><strong>–</strong><strong>–</strong>sales<strong>–</strong><strong>–</strong>purchases<strong>–</strong><strong>–</strong>importationsn separately record any purchases or importationsthat were for either<strong>–</strong><strong>–</strong>private use<strong>–</strong><strong>–</strong>making input taxed salesn identify any <strong>GST</strong>-free or input taxed sales.An example of how to keep <strong>your</strong> records so thatyou can use the accounts method can be found onpages 44<strong>–</strong>45.If you use the accounts method, the amounts you report on<strong>your</strong> <strong>activity</strong> <strong>statement</strong> at G1 (total sales) can be <strong>GST</strong>-inclusiveor <strong>GST</strong>-exclusive. You need to indicate whether the amountsinclude <strong>GST</strong> by marking either Yes or No with an ‘X’ in thebox under G1.G1 is the only label where you indicate a choice to report<strong>GST</strong>‐exclusive or <strong>GST</strong>-inclusive amounts. However, if you areusing the accounts method you can also complete the other<strong>GST</strong> labels as <strong>GST</strong>-inclusive or <strong>GST</strong>-exclusive.EXAMPLEIf you use the accounts method, you will need to get theseamounts from <strong>your</strong> accounting records and transfer themto <strong>your</strong> <strong>activity</strong> <strong>statement</strong>. Depending on which reportingoption you are using or required to use, not all of the <strong>GST</strong>labels indicated are required to be reported on each <strong>activity</strong><strong>statement</strong>.If you have <strong>your</strong> records set up in this way, you simply add upthe relevant <strong>GST</strong> amounts at the end of each reporting periodand report them at the appropriate labels on <strong>your</strong> <strong>activity</strong><strong>statement</strong>.Purchases and expenditureCash payments Capital purchases (incl. <strong>GST</strong>) Non‐capital purchases (incl. <strong>GST</strong>) <strong>GST</strong>TOTALSG10G111BSales and incomeCash receipts Total sales (incl. <strong>GST</strong>) <strong>GST</strong> Export sales Other <strong>GST</strong>‐free salesTOTALSG1 1A G2 G3If you use the accounts method, you must completelabels G1, G2, G3, G10 and G11 for information purposesonly. If necessary, you can estimate the amounts on areasonably accurate basis from <strong>your</strong> accounts.12

n4189-06-2011.indd 1IDENTIFY YOUR REPORTINGAND PAYMENT PERIODA04Your reporting and payment period will be one of the following:n report and pay <strong>your</strong> <strong>GST</strong> monthlyn quarterly<strong>–</strong><strong>–</strong>option 1 report and pay <strong>your</strong> <strong>GST</strong> quarterly<strong>–</strong><strong>–</strong>option 2 pay <strong>your</strong> <strong>GST</strong> quarterly and report annually<strong>–</strong><strong>–</strong>option 3 pay a <strong>GST</strong> instalment quarterly and report annuallyn report and pay <strong>GST</strong> annually (you can only use this optionif you are voluntarily registered for <strong>GST</strong>).REPORT AND PAY <strong>GST</strong> MONTHLYYou must use this option if <strong>your</strong> turnover is $20 million ormore. You may also choose to use this option irrespectiveof <strong>your</strong> turnover.If you report and pay <strong>GST</strong> monthly, you must report amountsat the following labels on <strong>your</strong> <strong>activity</strong> <strong>statement</strong> each month:n G1 (total sales)n G2 (export sales)n G3 (other <strong>GST</strong>-free sales)n G10 (capital purchases)n G11 (non-capital purchases)n 1A (<strong>GST</strong> on sales)n 1B (<strong>GST</strong> on purchases).For more information about reporting and paying <strong>GST</strong>monthly, refer to Reporting and paying <strong>GST</strong> monthly.QUARTERLY OPTIONSIf you report and pay <strong>GST</strong> quarterly, you may choose option1 or 2. Your <strong>activity</strong> <strong>statement</strong> will contain a label next to eachof the options. Place an ‘X’ in the label next to the option youhave chosen.If you are eligible, and have elected to use option 3,<strong>your</strong> <strong>activity</strong> <strong>statement</strong> or instalment notice will containa pre‐printed instalment amount at G21.Option When 1 <strong>completing</strong> <strong>–</strong> Calculate, this report form: and pay <strong>GST</strong> quarterlyUnder ■ print this option, clearly you using must a black report pen amounts at the followinglabels■on round <strong>your</strong> down <strong>activity</strong> to <strong>statement</strong> whole dollars each (do quarter: not show cents)n G1 ■ (total if reporting sales) a zero amount, print ‘0’ (do not use NIL)n G2 ■ (export leave boxes sales) blank if not applicable (do not use N/A, NIL)n G3 ■ (other do not <strong>GST</strong>-free report negative sales) figures or use symbols such as +, −, /, $n G10 (capital purchases)n Goods G11 (non-capital and services purchases) tax (<strong>GST</strong>)n 1A (<strong>GST</strong> on sales)n 1B (<strong>GST</strong> on purchases).Complete Option 1 OR 2 OR 3 (indicate one choice with an X)Option 1: Calculate <strong>GST</strong> and report quarterlyTotal sales(G1 requires 1A completed) G1 $ , , .00Does the amount shownat G1 include <strong>GST</strong>?(indicate with X)Report <strong>GST</strong> on sales at 1A and <strong>GST</strong> on purchases at 1Bin the Summary section over the pageNAT 4189-06.2011 [JS 20300]YesExport sales G2 $ , , .00Other <strong>GST</strong>-free sales G3 $ , , .00Capital purchases G10 $ , , .00Non-capital purchases G11 $ , , .00NoOROR(GRinW(lOW(lBPAY ® : contact <strong>your</strong> fi nancial institution to makethis payment from <strong>your</strong> cheque or savings account.Quote biller code 75556 and <strong>your</strong> EFT code (shownon the front of the payment slip) as the customerreference number.Credit card: payments can be made online or by phone, acard payment fee applies. Go to www.ato.gov.au/howtopayor phone 1300 898 089.Direct credit: you can electronically transfer funds to theATO’s direct credit bank account using online banking facilities.Use BSB 093 003, Account number 316 385 and <strong>your</strong>EFT code. Phone 1800 815 886 for assistance if required.Methods of payDirectinstitutiorganisMail pamoneystaplesPost ocheque$3,000presenChequeand pabe crosat any13