prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

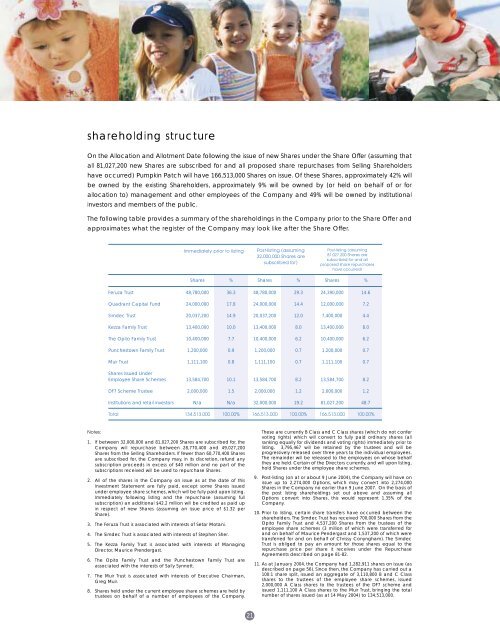

shareholding structureOn the Allocation and Allotment Date following the issue of new Shares under the Share Offer (assuming thatall 81,027,200 new Shares are subscribed <strong>for</strong> and all proposed share repurchases from Selling Shareholdershave occurred) <strong>Pumpkin</strong> <strong>Patch</strong> will have 166,513,000 Shares on issue. Of these Shares, approximately 42% willbe owned by the existing Shareholders, approximately 9% will be owned by (or held on behalf of or <strong>for</strong>allocation to) management and other employees of the Company and 49% will be owned by institutional<strong>investor</strong>s and members of the public.The following table provides a summary of the shareholdings in the Company prior to the Share Offer andapproximates what the register of the Company may look like after the Share Offer.Immediately prior to listingPost-listing (assuming32,000,000 Shares aresubscribed <strong>for</strong>)Post-listing (assuming81,027,200 Shares aresubscribed <strong>for</strong> and allproposed share repurchaseshave occurred)Shares % Shares % Shares %Feruza Trust 48,780,000 36.3 48,780,000 29.3 24,390,000 14.6Quadrant Capital Fund 24,000,000 17.8 24,000,000 14.4 12,000,000 7.2Simdec Trust 20,037,200 14.9 20,037,200 12.0 7,400,000 4.4Kezza Family Trust 13,400,000 10.0 13,400,000 8.0 13,400,000 8.0The Opito Family Trust 10,400,000 7.7 10,400,000 6.2 10,400,000 6.2Punchestown Family Trust 1,200,000 0.9 1,200,000 0.7 1,200,000 0.7Muir Trust 1,111,100 0.8 1,111,100 0.7 1,111,100 0.7Shares Issued UnderEmployee Share Schemes 13,584,700 10.1 13,584,700 8.2 13,584,700 8.2DF7 Scheme Trustee 2,000,000 1.5 2,000,000 1.2 2,000,000 1.2Institutions and retail <strong>investor</strong>s N/a N/a 32,000,000 19.2 81,027,200 48.7Total 134,513,000 100.00% 166,513,000 100.00% 166,513,000 100.00%Notes:1. If between 32,000,000 and 81,027,200 Shares are subscribed <strong>for</strong>, theCompany will repurchase between 28,770,400 and 49,027,200Shares from the Selling Shareholders. If fewer than 60,770,400 Sharesare subscribed <strong>for</strong>, the Company may, in its discretion, refund anysubscription proceeds in excess of $40 million and no part of thesubscriptions received will be used to repurchase Shares.2. All of the shares in the Company on issue as at the date of thisInvestment Statement are fully paid, except some Shares issuedunder employee share schemes, which will be fully paid upon listing.Immediately following listing and the repurchase (assuming fullsubscription) an additional $42.2 million will be credited as paid upin respect of new Shares (assuming an issue price of $1.32 perShare).3. The Feruza Trust is associated with interests of Setar Motani.4. The Simdec Trust is associated with interests of Stephen Sher.5. The Kezza Family Trust is associated with interests of ManagingDirector, Maurice Prendergast.6. The Opito Family Trust and the Punchestown Family Trust areassociated with the interests of Sally Synnott.7. The Muir Trust is associated with interests of Executive Chairman,Greg Muir.8. Shares held under the current employee share schemes are held bytrustees on behalf of a number of employees of the Company.These are currently B Class and C Class shares (which do not confervoting rights) which will convert to fully paid ordinary shares (allranking equally <strong>for</strong> dividends and voting rights) immediately prior tolisting. 3,795,467 will be retained by the trustees and will beprogressively released over three years to the individual employees.The remainder will be released to the employees on whose behalfthey are held. Certain of the Directors currently, and will upon listing,hold Shares under the employee share schemes.9. Post-listing (on at or about 9 June 2004), the Company will have onissue up to 2,274,000 Options, which may convert into 2,274,000Shares in the Company no earlier than 9 June 2007. On the basis ofthe post listing shareholdings set out above and assuming allOptions convert into Shares, this would represent 1.35% of theCompany.10. Prior to listing, certain share transfers have occurred between theshareholders. The Simdec Trust has received 700,000 Shares from theOpito Family Trust and 4,537,200 Shares from the trustees of theemployee share schemes (3 million of which were transferred <strong>for</strong>and on behalf of Maurice Pendergast and 1,537,200 of which weretransferred <strong>for</strong> and on behalf of Chrissy Conyngham). The SimdecTrust is obliged to pay an amount <strong>for</strong> those shares equal to therepurchase price per share it receives under the RepurchaseAgreements described on page 81-82.11. As at January 2004, the Company had 1,282,911 shares on issue (asdescribed on page 56). Since then, the Company has carried out a100:1 share split, issued an aggregate of 3,110,800 B and C Classshares to the trustees of the employee share schemes, issued2,000,000 A Class shares to the trustees of the DF7 scheme andissued 1,111,100 A Class shares to the Muir Trust, bringing the totalnumber of shares issued (as at 14 May 2004) to 134,513,000.21