prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

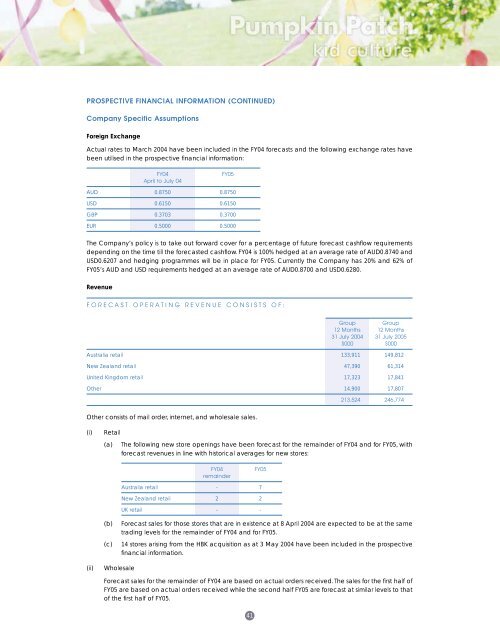

PROSPECTIVE FINANCIAL INFORMATION (CONTINUED)Company Specific AssumptionsForeign ExchangeActual rates to March 2004 have been included in the FY04 <strong>for</strong>ecasts and the following exchange rates havebeen utilised in the prospective financial in<strong>for</strong>mation:FY04April to July 04FY05AUD 0.8750 0.8750USD 0.6150 0.6150GBP 0.3703 0.3700EUR 0.5000 0.5000The Company’s policy is to take out <strong>for</strong>ward cover <strong>for</strong> a percentage of future <strong>for</strong>ecast cashflow requirementsdepending on the time till the <strong>for</strong>ecasted cashflow. FY04 is 100% hedged at an average rate of AUD0.8740 andUSD0.6207 and hedging programmes will be in place <strong>for</strong> FY05. Currently the Company has 20% and 62% ofFY05’s AUD and USD requirements hedged at an average rate of AUD0.8700 and USD0.6280.RevenueFORECAST OPERATING REVENUE CONSISTS OF:Group Group12 Months 12 Months31 July 2004 31 July 2005$000 $000Australia retail 133,911 149,812New Zealand retail 47,390 61,314United Kingdom retail 17,323 17,841Other 14,900 17,807213,524 246,774Other consists of mail order, internet, and wholesale sales.(i)Retail(a) The following new store openings have been <strong>for</strong>ecast <strong>for</strong> the remainder of FY04 and <strong>for</strong> FY05, wiith<strong>for</strong>ecast revenues in line with historical averages <strong>for</strong> new stores:FY04remainderFY05Australia retail - 7New Zealand retail 2 2UK retail - -(b)(c)Forecast sales <strong>for</strong> those stores that are in existence at 8 April 2004 are expected to be at the sametrading levels <strong>for</strong> the remainder of FY04 and <strong>for</strong> FY05.14 stores arising from the HBK acquisition as at 3 May 2004 have been included in the prospectivefinancial in<strong>for</strong>mation.(ii)WholesaleForecast sales <strong>for</strong> the remainder of FY04 are based on actual orders received. The sales <strong>for</strong> the first half ofFY05 are based on actual orders received while the second half FY05 are <strong>for</strong>ecast at similar levels to thatof the first half of FY05.41