prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

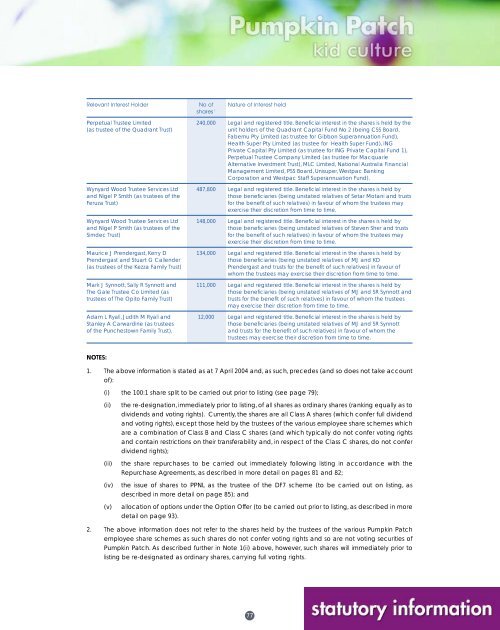

Relevant Interest Holder No of Nature of Interest heldshares 1Perpetual Trustee Limited(as trustee of the Quadrant Trust)Wynyard Wood Trustee Services Ltdand Nigel P Smith (as trustees of theFeruza Trust)Wynyard Wood Trustee Services Ltdand Nigel P Smith (as trustees of theSimdec Trust)Maurice J Prendergast, Kerry DPrendergast and Stuart G Callender(as trustees of the Kezza Family Trust)Mark J Synnott, Sally R Synnott andThe Gale Trustee Co Limited (astrustees of The Opito Family Trust)240,000 Legal and registered title. Beneficial interest in the shares is held by theunit holders of the Quadrant Capital Fund No 2 (being CSS Board,Fabemu Pty Limited (as trustee <strong>for</strong> Gibbon Superannuation Fund),Health Super Pty Limited (as trustee <strong>for</strong> Health Super Fund), INGPrivate Capital Pty Limited (as trustee <strong>for</strong> ING Private Capital Fund 1),Perpetual Trustee Company Limited (as trustee <strong>for</strong> MacquarieAlternative Investment Trust), MLC Limited, National Australia FinancialManagement Limited, PSS Board, Unisuper, Westpac BankingCorporation and Westpac Staff Superannuation Fund).487,800 Legal and registered title. Beneficial interest in the shares is held bythose beneficiaries (being unstated relatives of Setar Motani and trusts<strong>for</strong> the benefit of such relatives) in favour of whom the trustees mayexercise their discretion from time to time.148,000 Legal and registered title. Beneficial interest in the shares is held bythose beneficiaries (being unstated relatives of Steven Sher and trusts<strong>for</strong> the benefit of such relatives) in favour of whom the trustees mayexercise their discretion from time to time.134,000 Legal and registered title. Beneficial interest in the shares is held bythose beneficiaries (being unstated relatives of MJ and KDPrendergast and trusts <strong>for</strong> the benefit of such relatives) in favour ofwhom the trustees may exercise their discretion from time to time.111,000 Legal and registered title. Beneficial interest in the shares is held bythose beneficiaries (being unstated relatives of MJ and SR Synnott andtrusts <strong>for</strong> the benefit of such relatives) in favour of whom the trusteesmay exercise their discretion from time to time.Adam L Ryall, Judith M Ryall and 12,000 Legal and registered title. Beneficial interest in the shares is held byStanley A Carwardine (as trusteesthose beneficiaries (being unstated relatives of MJ and SR Synnottof the Punchestown Family Trust).and trusts <strong>for</strong> the benefit of such relatives) in favour of whom thetrustees may exercise their discretion from time to time.NOTES:1. The above in<strong>for</strong>mation is stated as at 7 April 2004 and, as such, precedes (and so does not take accountof):(i) the 100:1 share split to be carried out prior to listing (see page 79);(ii)(iii)(iv)(v)the re-designation, immediately prior to listing, of all shares as ordinary shares (ranking equally as todividends and voting rights). Currently, the shares are all Class A shares (which confer full dividendand voting rights), except those held by the trustees of the various employee share schemes whichare a combination of Class B and Class C shares (and which typically do not confer voting rightsand contain restrictions on their transferability and, in respect of the Class C shares, do not conferdividend rights);the share repurchases to be carried out immediately following listing in accordance with theRepurchase Agreements, as described in more detail on pages 81 and 82;the issue of shares to PPNL as the trustee of the DF7 scheme (to be carried out on listing, asdescribed in more detail on page 85); andallocation of options under the Option Offer (to be carried out prior to listing, as described in moredetail on page 93).2. The above in<strong>for</strong>mation does not refer to the shares held by the trustees of the various <strong>Pumpkin</strong> <strong>Patch</strong>employee share schemes as such shares do not confer voting rights and so are not voting securities of<strong>Pumpkin</strong> <strong>Patch</strong>. As described further in Note 1(ii) above, however, such shares will immediately prior tolisting be re-designated as ordinary shares, carrying full voting rights.77