prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

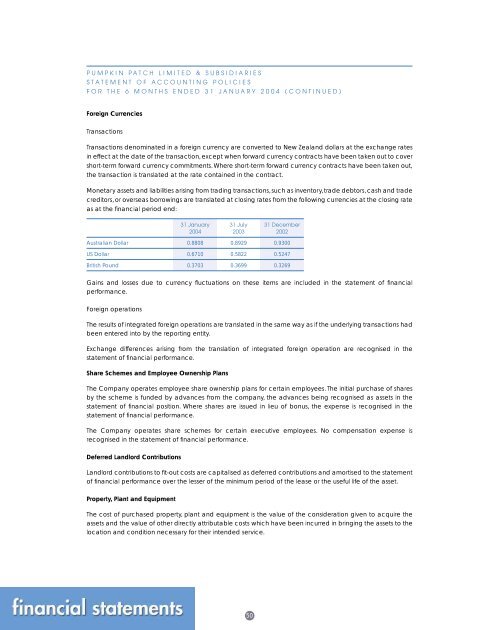

PUMPKIN PATCH LIMITED & SUBSIDIARIESSTATEMENT OF ACCOUNTING POLICIESFOR THE 6 MONTHS ENDED 31 JANUARY 2004 (CONTINUED)Foreign CurrenciesTransactionsTransactions denominated in a <strong>for</strong>eign currency are converted to New Zealand dollars at the exchange ratesin effect at the date of the transaction, except when <strong>for</strong>ward currency contracts have been taken out to covershort-term <strong>for</strong>ward currency commitments. Where short-term <strong>for</strong>ward currency contracts have been taken out,the transaction is translated at the rate contained in the contract.Monetary assets and liabilities arising from trading transactions, such as inventory, trade debtors, cash and tradecreditors, or overseas borrowings are translated at closing rates from the following currencies at the closing rateas at the financial period end:31 January 31 July 31 December2004 2003 2002Australian Dollar 0.8808 0.8929 0.9300US Dollar 0.6710 0.5822 0.5247British Pound 0.3703 0.3699 0.3269Gains and losses due to currency fluctuations on these items are included in the statement of financialper<strong>for</strong>mance.Foreign operationsThe results of integrated <strong>for</strong>eign operations are translated in the same way as if the underlying transactions hadbeen entered into by the reporting entity.Exchange differences arising from the translation of integrated <strong>for</strong>eign operation are recognised in thestatement of financial per<strong>for</strong>mance.Share Schemes and Employee Ownership PlansThe Company operates employee share ownership plans <strong>for</strong> certain employees. The initial purchase of sharesby the scheme is funded by advances from the company, the advances being recognised as assets in thestatement of financial position. Where shares are issued in lieu of bonus, the expense is recognised in thestatement of financial per<strong>for</strong>mance.The Company operates share schemes <strong>for</strong> certain executive employees. No compensation expense isrecognised in the statement of financial per<strong>for</strong>mance.Deferred Landlord ContributionsLandlord contributions to fit-out costs are capitalised as deferred contributions and amortised to the statementof financial per<strong>for</strong>mance over the lesser of the minimum period of the lease or the useful life of the asset.Property, Plant and EquipmentThe cost of purchased property, plant and equipment is the value of the consideration given to acquire theassets and the value of other directly attributable costs which have been incurred in bringing the assets to thelocation and condition necessary <strong>for</strong> their intended service.50