prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

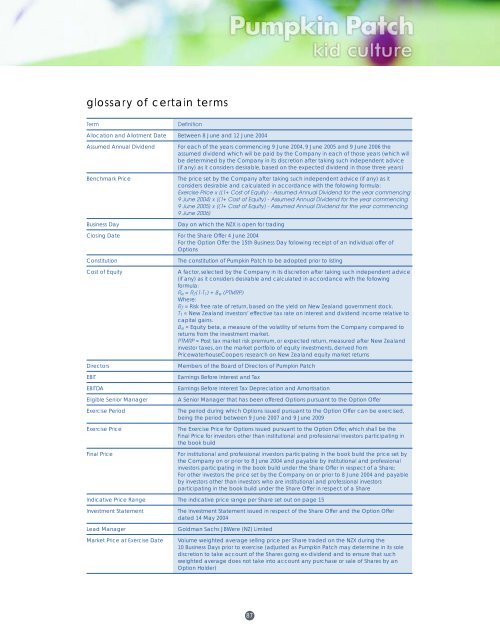

glossary of certain termsTermDefinitionAllocation and Allotment Date Between 8 June and 12 June 2004Assumed Annual DividendBenchmark PriceBusiness DayFor each of the years commencing 9 June 2004, 9 June 2005 and 9 June 2006 theassumed dividend which will be paid by the Company in each of those years (which willbe determined by the Company in its discretion after taking such independent advice(if any) as it considers desirable, based on the expected dividend in those three years)The price set by the Company after taking such independent advice (if any) as itconsiders desirable and calculated in accordance with the following <strong>for</strong>mula:Exercise Price x [(1+ Cost of Equity) - Assumed Annual Dividend <strong>for</strong> the year commencing9 June 2004] x [(1+ Cost of Equity) - Assumed Annual Dividend <strong>for</strong> the year commencing9 June 2005] x [(1+ Cost of Equity) - Assumed Annual Dividend <strong>for</strong> the year commencing9 June 2006]Day on which the NZX is open <strong>for</strong> tradingClosing Date For the Share Offer 4 June 2004For the Option Offer the 15th Business Day following receipt of an individual offer ofOptionsConstitutionCost of EquityDirectorsEBITEBITDAEligible Senior ManagerExercise PeriodExercise PriceFinal PriceThe constitution of <strong>Pumpkin</strong> <strong>Patch</strong> to be adopted prior to listingA factor, selected by the Company in its discretion after taking such independent advice(if any) as it considers desirable and calculated in accordance with the following<strong>for</strong>mula:R e = R ƒ(1-T 1) + ß e (PTMRP)Where:R ƒ = Risk free rate of return, based on the yield on New Zealand government stock.T 1 = New Zealand <strong>investor</strong>s’ effective tax rate on interest and dividend income relative tocapital gains.ß e = Equity beta, a measure of the volatility of returns from the Company compared toreturns from the investment market.PTMRP = Post tax market risk premium, or expected return, measured after New Zealand<strong>investor</strong> taxes, on the market portfolio of equity investments, derived fromPricewaterhouseCoopers research on New Zealand equity market returnsMembers of the Board of Directors of <strong>Pumpkin</strong> <strong>Patch</strong>Earnings Be<strong>for</strong>e Interest and TaxEarnings Be<strong>for</strong>e Interest Tax Depreciation and AmortisationA Senior Manager that has been offered Options pursuant to the Option OfferThe period during which Options issued pursuant to the Option Offer can be exercised,being the period between 9 June 2007 and 9 June 2009The Exercise Price <strong>for</strong> Options issued pursuant to the Option Offer, which shall be theFinal Price <strong>for</strong> <strong>investor</strong>s other than institutional and professional <strong>investor</strong>s participating inthe book buildFor institutional and professional <strong>investor</strong>s participating in the book build the price set bythe Company on or prior to 8 June 2004 and payable by institutional and professional<strong>investor</strong>s participating in the book build under the Share Offer in respect of a Share;For other <strong>investor</strong>s the price set by the Company on or prior to 8 June 2004 and payableby <strong>investor</strong>s other than <strong>investor</strong>s who are institutional and professional <strong>investor</strong>sparticipating in the book build under the Share Offer in respect of a ShareIndicative Price Range The indicative price range per Share set out on page 15Investment StatementLead ManagerMarket Price at Exercise DateThe Investment Statement issued in respect of the Share Offer and the Option Offerdated 14 May 2004Goldman Sachs JBWere (NZ) LimitedVolume weighted average selling price per Share traded on the NZX during the10 Business Days prior to exercise (adjusted as <strong>Pumpkin</strong> <strong>Patch</strong> may determine in its solediscretion to take account of the Shares going ex-dividend and to ensure that suchweighted average does not take into account any purchase or sale of Shares by anOption Holder)87