prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

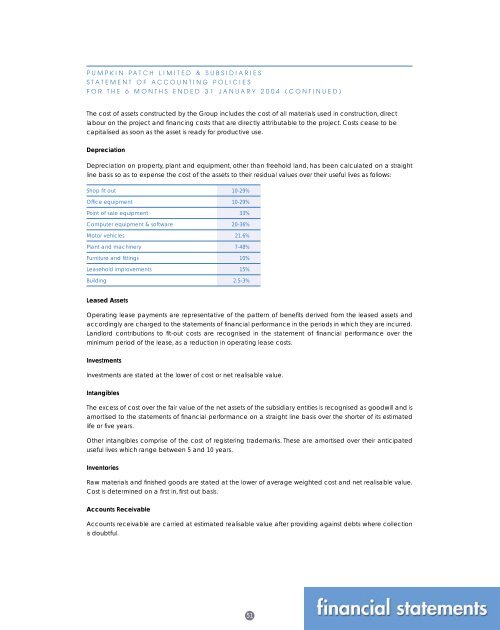

PUMPKIN PATCH LIMITED & SUBSIDIARIESSTATEMENT OF ACCOUNTING POLICIESFOR THE 6 MONTHS ENDED 31 JANUARY 2004 (CONTINUED)The cost of assets constructed by the Group includes the cost of all materials used in construction, directlabour on the project and financing costs that are directly attributable to the project. Costs cease to becapitalised as soon as the asset is ready <strong>for</strong> productive use.DepreciationDepreciation on property, plant and equipment, other than freehold land, has been calculated on a straightline basis so as to expense the cost of the assets to their residual values over their useful lives as follows:Shop fit out 10-29%Office equipment 10-29%Point of sale equipment 33%Computer equipment & software 20-36%Motor vehicles 21.6%Plant and machinery 7-48%Furniture and fittings 10%Leasehold improvements 15%Building 2.5-3%Leased AssetsOperating lease payments are representative of the pattern of benefits derived from the leased assets andaccordingly are charged to the statements of financial per<strong>for</strong>mance in the periods in which they are incurred.Landlord contributions to fit-out costs are recognised in the statement of financial per<strong>for</strong>mance over theminimum period of the lease, as a reduction in operating lease costs.InvestmentsInvestments are stated at the lower of cost or net realisable value.IntangiblesThe excess of cost over the fair value of the net assets of the subsidiary entities is recognised as goodwill and isamortised to the statements of financial per<strong>for</strong>mance on a straight line basis over the shorter of its estimatedlife or five years.Other intangibles comprise of the cost of registering trademarks. These are amortised over their anticipateduseful lives which range between 5 and 10 years.InventoriesRaw materials and finished goods are stated at the lower of average weighted cost and net realisable value.Cost is determined on a first in, first out basis.Accounts ReceivableAccounts receivable are carried at estimated realisable value after providing against debts where collectionis doubtful.51