prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

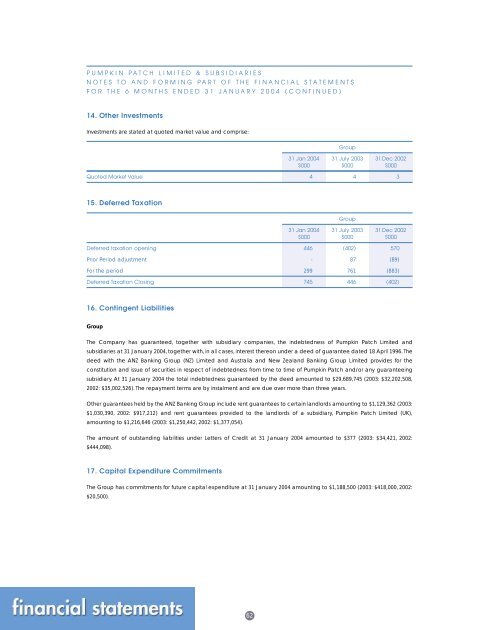

PUMPKIN PATCH LIMITED & SUBSIDIARIESNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTSFOR THE 6 MONTHS ENDED 31 JANUARY 2004 (CONTINUED)14. Other InvestmentsInvestments are stated at quoted market value and comprise:Group31 Jan 2004 31 July 2003 31 Dec 2002$000 $000 $000Quoted Market Value 4 4 315. Deferred TaxationGroup31 Jan 2004 31 July 2003 31 Dec 2002$000 $000 $000Deferred taxation opening 446 (402) 570Prior Period adjustment - 87 (89)For the period 299 761 (883)Deferred Taxation Closing 745 446 (402)16. Contingent LiabilitiesGroupThe Company has guaranteed, together with subsidiary companies, the indebtedness of <strong>Pumpkin</strong> <strong>Patch</strong> Limited andsubsidiaries at 31 January 2004, together with, in all cases, interest thereon under a deed of guarantee dated 18 April 1996. Thedeed with the ANZ Banking Group (NZ) Limited and Australia and New Zealand Banking Group Limited provides <strong>for</strong> theconstitution and issue of securities in respect of indebtedness from time to time of <strong>Pumpkin</strong> <strong>Patch</strong> and/or any guaranteeingsubsidiary. At 31 January 2004 the total indebtedness guaranteed by the deed amounted to $29,689,745 (2003: $32,202,508,2002: $35,002,526). The repayment terms are by instalment and are due over more than three years.Other guarantees held by the ANZ Banking Group include rent guarantees to certain landlords amounting to $1,129,362 (2003:$1,030,390, 2002: $917,212) and rent guarantees provided to the landlords of a subsidiary, <strong>Pumpkin</strong> <strong>Patch</strong> Limited (UK),amounting to $1,216,646 (2003: $1,250,442, 2002: $1,377,054).The amount of outstanding liabilities under Letters of Credit at 31 January 2004 amounted to $377 (2003: $34,421, 2002:$444,098).17. Capital Expenditure CommitmentsThe Group has commitments <strong>for</strong> future capital expenditure at 31 January 2004 amounting to $1,188,500 (2003: $418,000, 2002:$20,500).62