prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

prospectus for - Pumpkin Patch investor relations

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

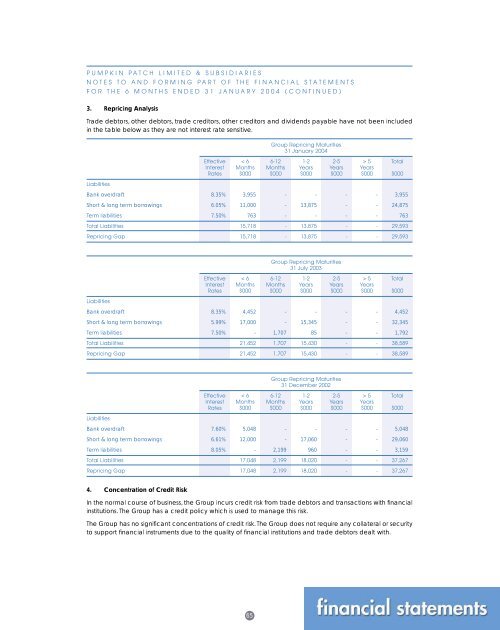

PUMPKIN PATCH LIMITED & SUBSIDIARIESNOTES TO AND FORMING PART OF THE FINANCIAL STATEMENTSFOR THE 6 MONTHS ENDED 31 JANUARY 2004 (CONTINUED)3. Repricing AnalysisTrade debtors, other debtors, trade creditors, other creditors and dividends payable have not been includedin the table below as they are not interest rate sensitive.Group Repricing Maturities31 January 2004Effective < 6 6-12 1-2 2-5 > 5 TotalInterest Months Months Years Years YearsRates $000 $000 $000 $000 $000 $000LiabilitiesBank overdraft 8.35% 3,955 - - - - 3,955Short & long term borrowings 6.05% 11,000 - 13,875 - - 24,875Term liabilities 7.50% 763 - - - - 763Total Liabilities 15,718 - 13,875 - - 29,593Repricing Gap 15,718 - 13,875 - - 29,593Group Repricing Maturities31 July 2003Effective < 6 6-12 1-2 2-5 > 5 TotalInterest Months Months Years Years YearsRates $000 $000 $000 $000 $000 $000LiabilitiesBank overdraft 8.35% 4,452 - - - - 4,452Short & long term borrowings 5.99% 17,000 - 15,345 - - 32,345Term liabilities 7.50% - 1,707 85 - - 1,792Total Liabilities 21,452 1,707 15,430 - - 38,589Repricing Gap 21,452 1,707 15,430 - - 38,589Group Repricing Maturities31 December 2002Effective < 6 6-12 1-2 2-5 > 5 TotalInterest Months Months Years Years YearsRates $000 $000 $000 $000 $000 $000LiabilitiesBank overdraft 7.60% 5,048 - - - - 5,048Short & long term borrowings 6.61% 12,000 - 17,060 - - 29,060Term liabilities 8.05% - 2,199 960 - - 3,159Total Liabilities 17,048 2,199 18,020 - - 37,267Repricing Gap 17,048 2,199 18,020 - - 37,2674. Concentration of Credit RiskIn the normal course of business, the Group incurs credit risk from trade debtors and transactions with financialinstitutions. The Group has a credit policy which is used to manage this risk.The Group has no significant concentrations of credit risk. The Group does not require any collateral or securityto support financial instruments due to the quality of financial institutions and trade debtors dealt with.65