Campus and Residential Life - Briar Cliff University

Campus and Residential Life - Briar Cliff University

Campus and Residential Life - Briar Cliff University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

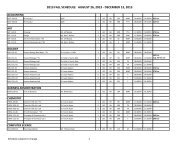

Financial Aid<strong>Briar</strong> <strong>Cliff</strong> provides financial assistance to students based on available resources <strong>and</strong> ensuresequal access to all students. Aid is provided in the form of scholarships, grants, work, <strong>and</strong>loans. Students seeking financial assistance must file the Free Application for FederalStudent Aid (FAFSA). <strong>Briar</strong> <strong>Cliff</strong>’s Title IV Code (001846) must be listed in the appropriatesection. Once the FAFSA is completed <strong>and</strong> a Student Aid Report is received, otherdocumentation may be required before an official Award Letter is processed. The AwardLetter outlines the specific financial aid that is offered to the student. Refer to the FinancialAid Guide online for more information on the various aid programs. Financial Aid ispackaged in the following order:Federal grants, state <strong>and</strong> private grantsInstitutional scholarships <strong>and</strong> grantsFederal work studyFederal student loansOther resourcesTYPES OF FINANCIAL AIDScholarships <strong>and</strong> grants: Federal, state <strong>and</strong> institutional grants are awarded based on thequalifications defined in each grant program. Federal grants based on financial need includethe Pell Grant <strong>and</strong> the Supplemental Education Opportunity Grant. State grants based onfinancial need include the Iowa Tuition Grant <strong>and</strong> the Iowa Grant. <strong>Briar</strong> <strong>Cliff</strong> awardsinstitutional scholarships based on academic achievement, talent, merit, <strong>and</strong> financialneed. Academic scholarships are reduced <strong>and</strong> grants could be reduced or eliminated if astudent moves out of the campus residence halls.You must be a full time day student in the undergraduate program to be eligible forinstitutional aid. Full time at <strong>Briar</strong> <strong>Cliff</strong> <strong>University</strong> is considered to be 12-18 credit hours persemester. Institutional aid is not awarded to part-time students.Federal student loans include the Federal Direct <strong>and</strong> the Federal Perkins Loans. For aFederal Direct Loan, a Master Promissory Note <strong>and</strong> an Entrance Interview must becompleted online for first-time borrowers. Perkins Loans require additional paperwork <strong>and</strong>instructions will be made available to the student. Federal Loan proceeds are crediteddirectly to the student’s account.FINANCIAL AID SATISFACTORY ACADEMIC PROGRESSThe Higher Education Act of 1965, as amended, requires that each student maintainssatisfactory progress in the course of study the student is pursuing in order to receive TitleIV Federal Financial Aid. At <strong>Briar</strong> <strong>Cliff</strong>, these st<strong>and</strong>ards are also applied to state <strong>and</strong>institutional programs. Students attending full-time have a maximum of five academic yearsto complete a program of study at <strong>Briar</strong> <strong>Cliff</strong>. Students will only receive state funding forfour academic years. If the student’s major requires additional completion time, a fifth yearof institutional funding may be allowed by appealing to the Financial Aid Office.Academic progress will be measured both qualitatively <strong>and</strong> quantitatively. A minimum gradepoint average <strong>and</strong> a minimum number of credit hours completed in the academic year arerequirements (see chart below).16