qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

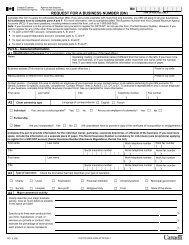

Shall not consist of:• Occupations that discharge or emit odorous,noxious or toxic matter or vapours; heat, glare,noise or radiation; or recurrently generatedground vibrations.• Occupations that result in traffic congestion,electrical interference, fire hazard or healthhazards.Building Regulations and CodesThe municipal government office – City Hall – isalso the place to get information about other bylawsthat could affect a home-based business onthings like parking, signage, noise and buildingcodes.Building regulations are important to research ifany building has to be done or any changes needto be made to your existing buildings. Plumbingand electrical work may require upgrading. Theprovincial building code applies across theprovince. Permits are also needed in differentareas for certain kinds of work. Be sure of yourbasic zoning approval before undertaking anyrenovation.Permission and PermitsIf you rent or lease your house, certainagreements may be needed between you and theowner. Starting a home-based business ina place you don’t own is advisable only with fullknowledge and permission of the owner.Look at what’s allowed under your tenancyagreement.provincial Ministry of Environment, WasteManagement Branch for disposal of hazardousmaterials, or the local fire department for burningpermits.Most municipalities require and charge a fee fora business license.Certain businesses – in particular those involvingfood – require a health inspection and permit.The Health Inspector, an employee of theprovincial government, usually works closelywith local officials to safeguard the public health.Typical fees for business licensesThe following extract from the City of NanaimoBy-Law No. 3288 is an example of typicalannual license fees.From every person an annual license fee shall becharged for carrying on any of the followingbusinesses:Example<strong>Business</strong> ClassificationsMiscellaneousAdvertising agency 4803 $75.00Accounting/bookkeeper 4801 $55.00Answering service 5090 $75.00Animal-kennels/grooming 0100 $50.00Home OccupationsFor any of the aforementioned businesses that areclassified as home occupation, add $50.00 to thelicense fee stated for that particular business.A home-based business needs to considerbusiness license requirements, as well as healthor other permits – for example, permits from the56solutions for small business home-based business