qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

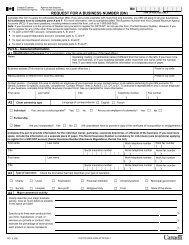

• Claim as deductions from taxable income theexpenses of the physical space you use. Claimeither the square footage used by the businessas a portion of your house’s square footage, orany room entirely given to your business in aratio with all the rooms in the house.• Claim pay phone and parking meters. Use yourdaily calendar or appointment book to recordsuch expenses for which you have no receipts.Transfer this record chronologically onto yourmonthly petty cash sheet, marking which arepaid by cash and especially noting cashexpenses that have no receipt. Without thathabit, small amounts of cash spent willcontinually dribble through your fingerswithout being recorded as business expenses.The ones paid by cheque will show up as abusiness expense in your cheque book.• Organize receipts in envelopes, then transferamounts to financial records. If you losereceipts, legitimate business expenses can stillbe deducted. Note the event and expense inyour appointment book and include with otherreceipts a brief explanation of any expensesclaimed but not supported by receipts.• Apply for a gasoline excise tax rebate,available for automobile use for business. Thepost office has application forms.• Identify and keep a running list of all businessassets and their costs; make sure you deductdepreciation allowance – called capital costallowance deductions in tax calculations.• Sub-contract instead of hiring employees, atleast initially. The benefits include lessadministration and paperwork and greaterflexibility to deal with changing workdemands. Once the business is established, itmakes sense to hire.<strong>Business</strong> NumberYou receive a <strong>Business</strong> Number (BN) when youopen up one or more of Canada Customs andRevenue Agency’s four main business accounts:These are:• Goods and Services Tax• Payroll deductions• Corporate income tax• Import/exportThe BN is a numbering system that identifies youand the various accounts you maintain.Registration kits can be obtained from <strong>Business</strong>Windows, located in many Canada Customs andRevenue Agency offices in <strong>BC</strong>.Handle the Goods and Services Tax (GST)Every business that has revenue of $30,000 ormore in any 12 month period must registerfor and from that point on collect the seven percent GST on their sales. In addition theymust file a GST return reporting the GSTcollected on their sales and the GST paid on theirpurchases. However, if you do not have revenueof more than $30,000 in any 12 month period,you are considered a “small trader”, and it isoptional to register for the GST. This means thatsmall traders who are not registered for the GSTdo not charge GST. If a small trader reaches the$30,000 limit within a 12 month period, they arerequired to register for the GST.90solutions for small business home-based business