qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

qprev_HBB Manual 2.qxd - Small Business BC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

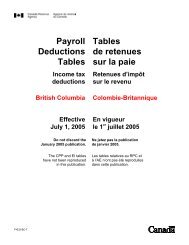

You may, however, choose to register even if youare a small trader. While the option of notregistering may look attractive, think carefullybefore choosing it. While not registering willsave you the time and cost of administering(collecting and remitting) GST, it also means thatthe 7% GST that you pay on all supplies andservices you purchase for your business cannotbe claimed back. As a small trader, you become,in effect, a consumer – not a business in thecontext of GST. In practical terms, this meansthat all the costs of a small trader (exceptsalaries, on which there is no GST) will risesignificantly under the system. The overall effecton your competitiveness will almost certainly benegative.Deciding whether to claim small trader status isfairly straightforward. You simply need tocalculate your taxable expenses for the year anddetermine whether the 7% you paid is “worth”the cost of registering and doing the paperworkof collecting and administering the GST. Youalso need to decide whether you can staycompetitive if your expenses are effectively 7%more than the next person’s.Monitor Customer CreditProviding financing arrangements for customerscan increase sales. In that way, credit is a salestool. However, managing credit requires settingup and keeping good records.Handling Accounts ReceivableOf particular importance is how you manageyour accounts receivable. As with other parts of acredit program, managing accounts receivablemeans learning to use records. Divide accountsreceivable into three categories; 30, 60 and 90days. A written letter will clean up most 30 and60 day overdues, while a telephone call canusually clear up 60 and 90 day overdues. Astandard recommendation for small businesses isto use a credit collection agency after 60 daysand before 90 days.In-House Credit ProgramIt’s common in any business to have to wait forpayment. Customers are billed or invoiced. Mostcredit programs charge interest after theallowable payment period.Financial plans have to consider the costs ofcarrying slow payments as well as bad debts.Payment delays occur for many reasons. Have acontingency or back-up plan in place for timeswhen payment takes months to arrive.Open Charge AccountCredit card companies survive on the percentageof card sales that businesses pay them. Thesepercentages run between three per cent and sixper cent, depending on volume and average sale.<strong>Business</strong>es with small sales pay a higher rate.A credit card program has these advantages overan in-house program:• The business owner doesn’t have to run acredit check.• You get your money right away.• Risk is less.• You save the time needed to bill customers forcredit sales.• Most of the buying public have and use creditcards.solutions for small business home-based business 91