Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

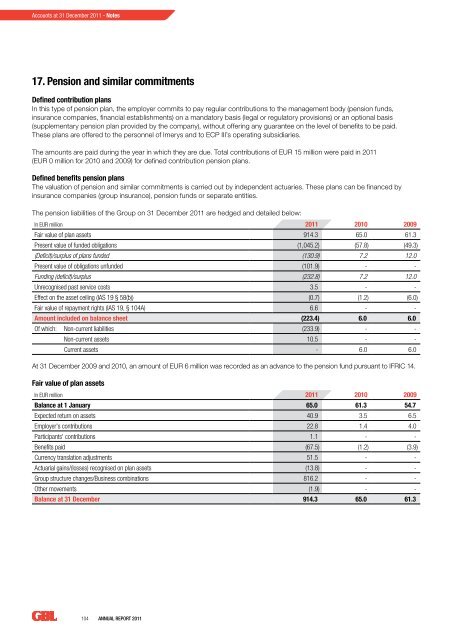

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Notes17. Pension and similar commitmentsDefined contribution plansIn this type of pension plan, the employer commits to pay regular contributions to the management body (pension funds,insurance companies, financial establishments) on a mandatory basis (legal or regulatory provisions) or an optional basis(supplementary pension plan provided by the company), without offering any guarantee on the level of <strong>be</strong>nefits to <strong>be</strong> paid.These plans are offered to the personnel of Imerys and to ECP III’s operating subsidiaries.The amounts are paid during the year in which they are due. Total contributions of EUR 15 million were paid in <strong>2011</strong>(EUR 0 million for 2010 and 2009) for defined contribution pension plans.Defined <strong>be</strong>nefits pension plansThe valuation of pension and similar commitments is carried out by independent actuaries. These plans can <strong>be</strong> financed byinsurance companies (group insurance), pension funds or separate entities.The pension liabilities of the Group on 31 Decem<strong>be</strong>r <strong>2011</strong> are hedged and detailed <strong>be</strong>low:In EUR million <strong>2011</strong> 2010 2009Fair value of plan assets 914.3 65.0 61.3Present value of funded obligations (1,045.2) (57.8) (49.3)(Deficit)/surplus of plans funded (130.9) 7.2 12.0Present value of obligations unfunded (101.9) - -Funding (deficit)/surplus (232.8) 7.2 12.0Unrecognised past service costs 3.5 - -Effect on the asset ceiling (IAS 19 § 58(b)) (0.7) (1.2) (6.0)Fair value of repayment rights (IAS 19, § 104A) 6.6 - -Amount included on balance sheet (223.4) 6.0 6.0Of which: Non-current liabilities (233.9) - -Non-current assets 10.5 - -Current assets - 6.0 6.0At 31 Decem<strong>be</strong>r 2009 and 2010, an amount of EUR 6 million was recorded as an advance to the pension fund pursuant to IFRIC 14.Fair value of plan assetsIn EUR million <strong>2011</strong> 2010 2009Balance at 1 January 65.0 61.3 54.7Expected return on assets 40.9 3.5 6.5Employer's contributions 22.8 1.4 4.0Participants' contributions 1.1 - -Benefits paid (67.5) (1.2) (3.9)Currency translation adjustments 51.5 - -Actuarial gains/(losses) recognised on plan assets (13.8) - -Group structure changes/Business combinations 816.2 - -Other movements (1.9) - -Balance at 31 Decem<strong>be</strong>r 914.3 65.0 61.3104 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>