Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

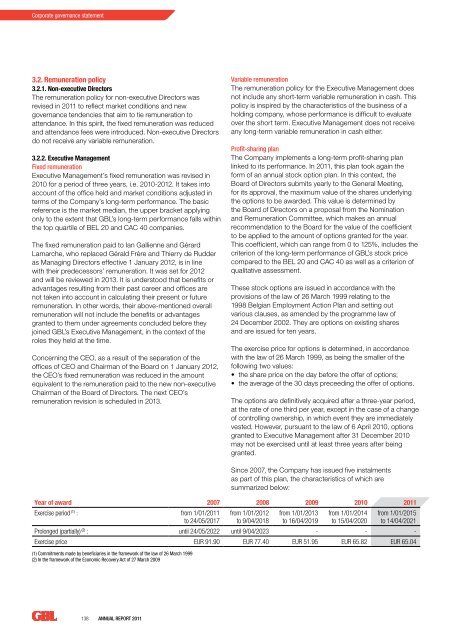

Corporate governance statement3.2. Remuneration policy3.2.1. Non-executive DirectorsThe remuneration policy for non-executive Directors wasrevised in <strong>2011</strong> to reflect market conditions and newgovernance tendencies that aim to tie remuneration toattendance. In this spirit, the fixed remuneration was reducedand attendance fees were introduced. Non-executive Directorsdo not receive any variable remuneration.3.2.2. Executive ManagementFixed remunerationExecutive Management’s fixed remuneration was revised in2010 for a period of three years, i.e. 2010-2012. It takes intoaccount of the office held and market conditions adjusted interms of the Company’s long-term performance. The basicreference is the market median, the upper bracket applyingonly to the extent that GBL’s long-term performance falls withinthe top quartile of BEL 20 and CAC 40 companies.The fixed remuneration paid to Ian Gallienne and GérardLamarche, who replaced Gérald Frère and Thierry de Rudderas Managing Directors effective 1 January 2012, is in linewith their predecessors’ remuneration. It was set for 2012and will <strong>be</strong> reviewed in 2013. It is understood that <strong>be</strong>nefits oradvantages resulting from their past career and offices arenot taken into account in calculating their present or futureremuneration. In other words, their above-mentioned overallremuneration will not include the <strong>be</strong>nefits or advantagesgranted to them under agreements concluded <strong>be</strong>fore theyjoined GBL’s Executive Management, in the context of theroles they held at the time.Concerning the CEO, as a result of the separation of theoffices of CEO and Chairman of the Board on 1 January 2012,the CEO’s fixed remuneration was reduced in the amountequivalent to the remuneration paid to the new non-executiveChairman of the Board of Directors. The next CEO’sremuneration revision is scheduled in 2013.Variable remunerationThe remuneration policy for the Executive Management doesnot include any short-term variable remuneration in cash. Thispolicy is inspired by the characteristics of the business of aholding company, whose performance is difficult to evaluateover the short term. Executive Management does not receiveany long-term variable remuneration in cash either.Profit-sharing planThe Company implements a long-term profit-sharing planlinked to its performance. In <strong>2011</strong>, this plan took again theform of an annual stock option plan. In this context, theBoard of Directors submits yearly to the General Meeting,for its approval, the maximum value of the shares underlyingthe options to <strong>be</strong> awarded. This value is determined bythe Board of Directors on a proposal from the Nominationand Remuneration Committee, which makes an annualrecommendation to the Board for the value of the coefficientto <strong>be</strong> applied to the amount of options granted for the year.This coefficient, which can range from 0 to 125%, includes thecriterion of the long-term performance of GBL’s stock pricecompared to the BEL 20 and CAC 40 as well as a criterion ofqualitative assessment.These stock options are issued in accordance with theprovisions of the law of 26 March 1999 relating to the1998 Belgian Employment Action Plan and setting outvarious clauses, as amended by the programme law of24 Decem<strong>be</strong>r 2002. They are options on existing sharesand are issued for ten years.The exercise price for options is determined, in accordancewith the law of 26 March 1999, as <strong>be</strong>ing the smaller of thefollowing two values:• the share price on the day <strong>be</strong>fore the offer of options;• the average of the 30 days preceeding the offer of options.The options are definitively acquired after a three-year period,at the rate of one third per year, except in the case of a changeof controlling ownership, in which event they are immediatelyvested. However, pursuant to the law of 6 April 2010, optionsgranted to Executive Management after 31 Decem<strong>be</strong>r 2010may not <strong>be</strong> exercised until at least three years after <strong>be</strong>inggranted.Since 2007, the Company has issued five instalmentsas part of this plan, the characteristics of which aresummarized <strong>be</strong>low:Year of award 2007 2008 2009 2010 <strong>2011</strong>Exercise period (1) : from 1/01/<strong>2011</strong>to 24/05/2017from 1/01/2012to 9/04/2018from 1/01/2013to 16/04/2019from 1/01/2014to 15/04/2020from 1/01/2015to 14/04/2021Prolonged (partially) (2) : until 24/05/2022 until 9/04/2023 - - -Exercise price EUR 91.90 EUR 77.40 EUR 51.95 EUR 65.82 EUR 65.04(1) Commitments made by <strong>be</strong>neficiaries in the framework of the law of 26 March 1999(2) In the framework of the Economic Recovery Act of 27 March 2009138 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>