Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

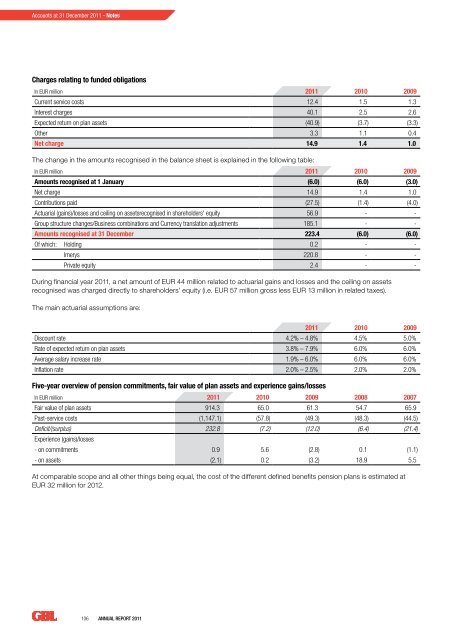

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - NotesCharges relating to funded obligationsIn EUR million <strong>2011</strong> 2010 2009Current service costs 12.4 1.5 1.3Interest charges 40.1 2.5 2.6Expected return on plan assets (40.9) (3.7) (3.3)Other 3.3 1.1 0.4Net charge 14.9 1.4 1.0The change in the amounts recognised in the balance sheet is explained in the following table:In EUR million <strong>2011</strong> 2010 2009Amounts recognised at 1 January (6.0) (6.0) (3.0)Net charge 14.9 1.4 1.0Contributions paid (27.5) (1.4) (4.0)Actuarial (gains)/losses and ceiling on assetsrecognised in shareholders' equity 56.9 - -Group structure changes/Business combinations and Currency translation adjustments 185.1 - -Amounts recognised at 31 Decem<strong>be</strong>r 223.4 (6.0) (6.0)Of which: Holding 0.2 - -Imerys 220.8 - -Private equity 2.4 - -During financial year <strong>2011</strong>, a net amount of EUR 44 million related to actuarial gains and losses and the ceiling on assetsrecognised was charged directly to shareholders’ equity (i.e. EUR 57 million gross less EUR 13 million in related taxes).The main actuarial assumptions are:<strong>2011</strong> 2010 2009Discount rate 4.2% – 4.8% 4.5% 5.0%Rate of expected return on plan assets 3.8% – 7.9% 6.0% 6.0%Average salary increase rate 1.9% – 6.0% 6.0% 6.0%Inflation rate 2.0% – 2.5% 2.0% 2.0%Five-year overview of pension commitments, fair value of plan assets and experience gains/lossesIn EUR million <strong>2011</strong> 2010 2009 2008 2007Fair value of plan assets 914.3 65.0 61.3 54.7 65.9Past-service costs (1,147.1) (57.8) (49.3) (48.3) (44.5)Deficit/(surplus) 232.8 (7.2) (12.0) (6.4) (21.4)Experience (gains)/losses- on commitments 0.9 5.6 (2.8) 0.1 (1.1)- on assets (2.1) 0.2 (3.2) 18.9 5.5At comparable scope and all other things <strong>be</strong>ing equal, the cost of the different defined <strong>be</strong>nefits pension plans is estimated atEUR 32 million for 2012.106 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>