Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

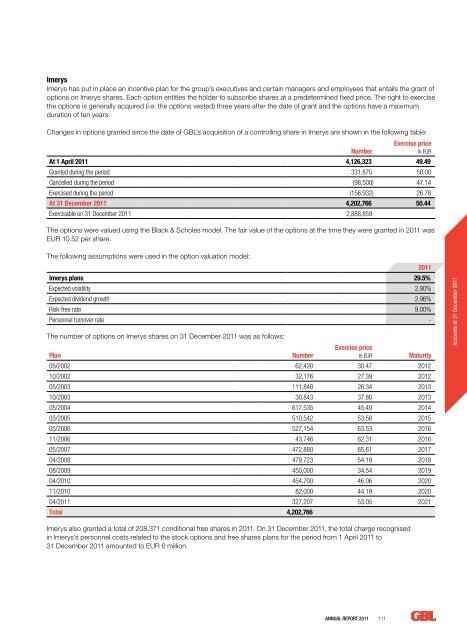

ImerysImerys has put in place an incentive plan for the group’s executives and certain managers and employees that entails the grant ofoptions on Imerys shares. Each option entitles the holder to subscri<strong>be</strong> shares at a predetermined fixed price. The right to exercisethe options is generally acquired (i.e. the options vested) three years after the date of grant and the options have a maximumduration of ten years.Changes in options granted since the date of GBL’s acquisition of a controlling share in Imerys are shown in the following table:Exercise priceNum<strong>be</strong>rIn EURAt 1 April <strong>2011</strong> 4,126,323 49.49Granted during the period 331,875 50.00Cancelled during the period (98,500) 47.14Exercised during the period (156,932) 26.78At 31 Decem<strong>be</strong>r <strong>2011</strong> 4,202,766 50.44Exercisable on 31 Decem<strong>be</strong>r <strong>2011</strong> 2,888,859The options were valued using the Black & Scholes model. The fair value of the options at the time they were granted in <strong>2011</strong> wasEUR 10.52 per share.The following assumptions were used in the option valuation model:<strong>2011</strong>Imerys plans 29.5%Expected volatility 2.90%Expected dividend growth 2.96%Risk-free rate 9.00%Personnel turnover rate -The num<strong>be</strong>r of options on Imerys shares on 31 Decem<strong>be</strong>r <strong>2011</strong> was as follows:PlanNum<strong>be</strong>rExercise priceIn EURMaturity05/2002 62,420 30.47 201210/2002 32,176 27.39 201205/2003 111,840 26.34 201310/2003 30,843 37.80 201305/2004 617,535 45.49 201405/2005 510,542 53.58 201505/2006 527,154 63.53 201611/2006 43,746 62.31 201605/2007 472,880 65.61 201704/2008 479,723 54.19 201808/2009 450,000 34.54 201904/2010 454,700 46.06 20<strong>2011</strong>/2010 82,000 44.19 202004/<strong>2011</strong> 327,207 53.05 2021Total 4,202,766Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong>Imerys also granted a total of 208,371 conditional free shares in <strong>2011</strong>. On 31 Decem<strong>be</strong>r <strong>2011</strong>, the total charge recognisedin Imerys’s personnel costs related to the stock options and free shares plans for the period from 1 April <strong>2011</strong> to31 Decem<strong>be</strong>r <strong>2011</strong> amounted to EUR 6 million.<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 111