Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

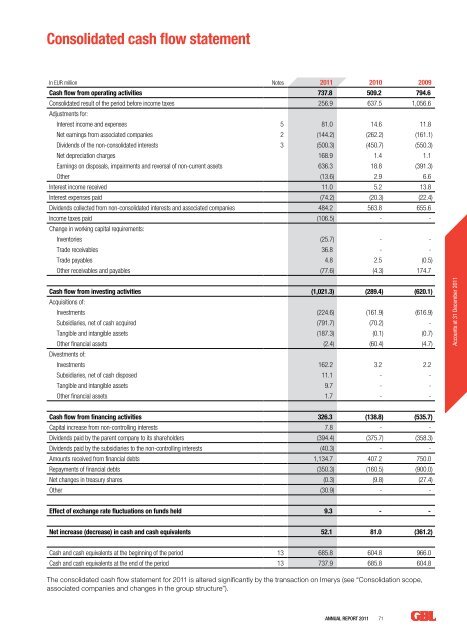

Consolidated cash flow statementIn EUR million Notes <strong>2011</strong> 2010 2009Cash flow from operating activities 737.8 509.2 794.6Consolidated result of the period <strong>be</strong>fore income taxes 256.9 637.5 1,056.6Adjustments for:Interest income and expenses 5 81.0 14.6 11.8Net earnings from associated companies 2 (144.2) (262.2) (161.1)Dividends of the non-consolidated interests 3 (500.3) (450.7) (550.3)Net depreciation charges 168.9 1.4 1.1Earnings on disposals, impairments and reversal of non-current assets 636.3 18.8 (391.3)Other (13.6) 2.9 6.6Interest income received 11.0 5.2 13.8Interest expenses paid (74.2) (20.3) (22.4)Dividends collected from non-consolidated interests and associated companies 484.2 563.8 655.6Income taxes paid (106.5) - -Change in working capital requirements:Inventories (25.7) - -Trade receivables 36.8 - -Trade payables 4.8 2.5 (0.5)Other receivables and payables (77.6) (4.3) 174.7Cash flow from investing activities (1,021.3) (289.4) (620.1)Acquisitions of:Investments (224.6) (161.9) (616.9)Subsidiaries, net of cash acquired (791.7) (70.2) -Tangible and intangible assets (187.3) (0.1) (0.7)Other financial assets (2.4) (60.4) (4.7)Divestments of:Investments 162.2 3.2 2.2Subsidiaries, net of cash disposed 11.1 - -Tangible and intangible assets 9.7 - -Other financial assets 1.7 - -Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong>Cash flow from financing activities 326.3 (138.8) (535.7)Capital increase from non-controlling interests 7.8 - -Dividends paid by the parent company to its shareholders (394.4) (375.7) (358.3)Dividends paid by the subsidiaries to the non-controlling interests (40.3) - -Amounts received from financial debts 1,134.7 407.2 750.0Repayments of financial debts (350.3) (160.5) (900.0)Net changes in treasury shares (0.3) (9.8) (27.4)Other (30.9) - -Effect of exchange rate fluctuations on funds held 9.3 - -Net increase (decrease) in cash and cash equivalents 52.1 81.0 (361.2)Cash and cash equivalents at the <strong>be</strong>ginning of the period 13 685.8 604.8 966.0Cash and cash equivalents at the end of the period 13 737.9 685.8 604.8The consolidated cash flow statement for <strong>2011</strong> is altered significantly by the transaction on Imerys (see “Consolidation scope,associated companies and changes in the group structure”).<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 71