Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

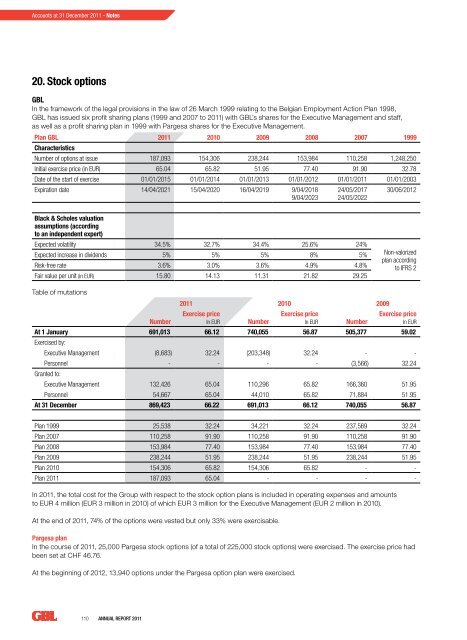

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Notes20. Stock optionsGBLIn the framework of the legal provisions in the law of 26 March 1999 relating to the Belgian Employment Action Plan 1998,GBL has issued six profit sharing plans (1999 and 2007 to <strong>2011</strong>) with GBL’s shares for the Executive Management and staff,as well as a profit sharing plan in 1999 with Pargesa shares for the Executive Management.Plan GBL <strong>2011</strong> 2010 2009 2008 2007 1999CharacteristicsNum<strong>be</strong>r of options at issue 187,093 154,306 238,244 153,984 110,258 1,248,250Initial exercise price (in EUR) 65.04 65.82 51.95 77.40 91.90 32.78Date of the start of exercise 01/01/2015 01/01/2014 01/01/2013 01/01/2012 01/01/<strong>2011</strong> 01/01/2003Expiration date 14/04/2021 15/04/2020 16/04/2019 9/04/20189/04/202324/05/201724/05/202230/06/2012Black & Scholes valuationassumptions (accordingto an independent expert)Expected volatility 34.5% 32.7% 34.4% 25.6% 24%Expected increase in dividends 5% 5% 5% 8% 5%Risk-free rate 3.6% 3.0% 3.6% 4.9% 4.8%Fair value per unit (in EUR) 15.80 14.13 11.31 21.82 29.25Non-valorizedplan accordingto IFRS 2Table of mutations<strong>2011</strong> 2010 2009Num<strong>be</strong>rExercise priceIn EUR Num<strong>be</strong>rExercise priceIn EUR Num<strong>be</strong>rExercise priceIn EURAt 1 January 691,013 66.12 740,055 56.87 505,377 59.02Exercised by:Executive Management (8,683) 32.24 (203,348) 32.24 - -Personnel - - - - (3,566) 32.24Granted to:Executive Management 132,426 65.04 110,296 65.82 166,360 51.95Personnel 54,667 65.04 44,010 65.82 71,884 51.95At 31 Decem<strong>be</strong>r 869,423 66.22 691,013 66.12 740,055 56.87Plan 1999 25,538 32.24 34,221 32.24 237,569 32.24Plan 2007 110,258 91.90 110,258 91.90 110,258 91.90Plan 2008 153,984 77.40 153,984 77.40 153,984 77.40Plan 2009 238,244 51.95 238,244 51.95 238,244 51.95Plan 2010 154,306 65.82 154,306 65.82 - -Plan <strong>2011</strong> 187,093 65.04 - - - -In <strong>2011</strong>, the total cost for the Group with respect to the stock option plans is included in operating expenses and amountsto EUR 4 million (EUR 3 million in 2010) of which EUR 3 million for the Executive Management (EUR 2 million in 2010).At the end of <strong>2011</strong>, 74% of the options were vested but only 33% were exercisable.Pargesa planIn the course of <strong>2011</strong>, 25,000 Pargesa stock options (of a total of 225,000 stock options) were exercised. The exercise price had<strong>be</strong>en set at CHF 46.76.At the <strong>be</strong>ginning of 2012, 13,940 options under the Pargesa option plan were exercised.110 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>