Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

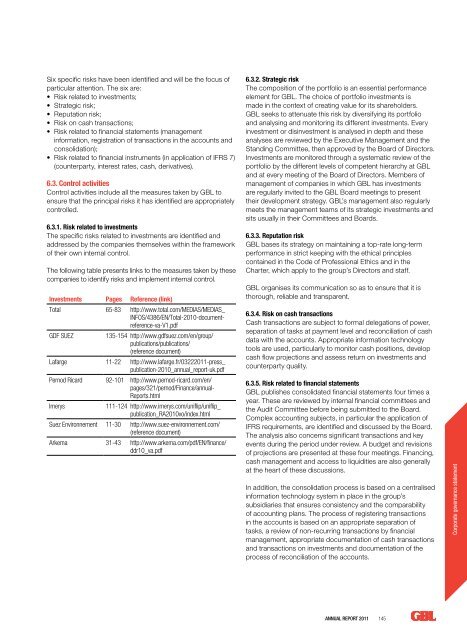

Six specific risks have <strong>be</strong>en identified and will <strong>be</strong> the focus ofparticular attention. The six are:• Risk related to investments;• Strategic risk;• Reputation risk;• Risk on cash transactions;• Risk related to financial statements (managementinformation, registration of transactions in the accounts andconsolidation);• Risk related to financial instruments (in application of IFRS 7)(counterparty, interest rates, cash, derivatives).6.3. Control activitiesControl activities include all the measures taken by GBL toensure that the principal risks it has identified are appropriatelycontrolled.6.3.1. Risk related to investmentsThe specific risks related to investments are identified andaddressed by the companies themselves within the frameworkof their own internal control.The following table presents links to the measures taken by thesecompanies to identify risks and implement internal control.Investments Pages Reference (link)Total 65-83 http://www.total.com/MEDIAS/MEDIAS_INFOS/4386/EN/Total-2010-documentreference-va-V1.pdfGDF SUEZ 135-154 http://www.gdfsuez.com/en/group/publications/publications/(reference document)Lafarge 11-22 http://www.lafarge.fr/0322<strong>2011</strong>-press_publication-2010_annual_report-uk.pdfPernod Ricard 92-101 http://www.pernod-ricard.com/en/pages/321/pernod/Finance/annual-<strong>Report</strong>s.htmlImerys111-124 http://www.imerys.com/uniflip/uniflip_publication_RA2010vo/index.htmlSuez Environnement 11-30 http://www.suez-environnement.com/(reference document)Arkema 31-43 http://www.arkema.com/pdf/EN/finance/ddr10_va.pdf6.3.2. Strategic riskThe composition of the portfolio is an essential performanceelement for GBL. The choice of portfolio investments ismade in the context of creating value for its shareholders.GBL seeks to attenuate this risk by diversifying its portfolioand analysing and monitoring its different investments. Everyinvestment or disinvestment is analysed in depth and theseanalyses are reviewed by the Executive Management and theStanding Committee, then approved by the Board of Directors.Investments are monitored through a systematic review of theportfolio by the different levels of competent hierarchy at GBLand at every meeting of the Board of Directors. Mem<strong>be</strong>rs ofmanagement of companies in which GBL has investmentsare regularly invited to the GBL Board meetings to presenttheir development strategy. GBL’s management also regularlymeets the management teams of its strategic investments andsits usually in their Committees and Boards.6.3.3. Reputation riskGBL bases its strategy on maintaining a top-rate long-termperformance in strict keeping with the ethical principlescontained in the Code of Professional Ethics and in theCharter, which apply to the group’s Directors and staff.GBL organises its communication so as to ensure that it isthorough, reliable and transparent.6.3.4. Risk on cash transactionsCash transactions are subject to formal delegations of power,separation of tasks at payment level and reconciliation of cashdata with the accounts. Appropriate information technologytools are used, particularly to monitor cash positions, developcash flow projections and assess return on investments andcounterparty quality.6.3.5. Risk related to financial statementsGBL publishes consolidated financial statements four times ayear. These are reviewed by internal financial committees andthe Audit Committee <strong>be</strong>fore <strong>be</strong>ing submitted to the Board.Complex accounting subjects, in particular the application ofIFRS requirements, are identified and discussed by the Board.The analysis also concerns significant transactions and keyevents during the period under review. A budget and revisionsof projections are presented at these four meetings. Financing,cash management and access to liquidities are also generallyat the heart of these discussions.In addition, the consolidation process is based on a centralisedinformation technology system in place in the group’ssubsidiaries that ensures consistency and the comparabilityof accounting plans. The process of registering transactionsin the accounts is based on an appropriate separation oftasks, a review of non-recurring transactions by financialmanagement, appropriate documentation of cash transactionsand transactions on investments and documentation of theprocess of reconciliation of the accounts.Corporate governance statement<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 145