Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

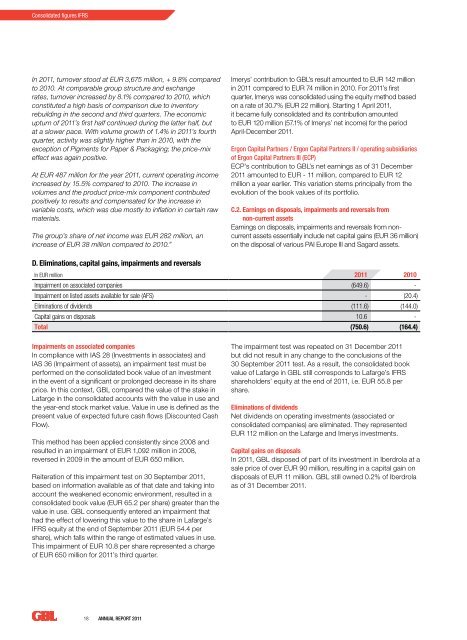

Consolidated figures IFRSIn <strong>2011</strong>, turnover stood at EUR 3,675 million, + 9.8% comparedto 2010. At comparable group structure and exchangerates, turnover increased by 8.1% compared to 2010, whichconstituted a high basis of comparison due to inventoryrebuilding in the second and third quarters. The economicupturn of <strong>2011</strong>’s first half continued during the latter half, butat a slower pace. With volume growth of 1.4% in <strong>2011</strong>’s fourthquarter, activity was slightly higher than in 2010, with theexception of Pigments for Paper & Packaging; the price-mixeffect was again positive.At EUR 487 million for the year <strong>2011</strong>, current operating incomeincreased by 15.5% compared to 2010. The increase involumes and the product price-mix component contributedpositively to results and compensated for the increase invariable costs, which was due mostly to inflation in certain rawmaterials.The group’s share of net income was EUR 282 million, anincrease of EUR 38 million compared to 2010.”Imerys’ contribution to GBL’s result amounted to EUR 142 millionin <strong>2011</strong> compared to EUR 74 million in 2010. For <strong>2011</strong>’s firstquarter, Imerys was consolidated using the equity method basedon a rate of 30.7% (EUR 22 million). Starting 1 April <strong>2011</strong>,it <strong>be</strong>came fully consolidated and its contribution amountedto EUR 120 million (57.1% of Imerys’ net income) for the periodApril-Decem<strong>be</strong>r <strong>2011</strong>.Ergon Capital Partners / Ergon Capital Partners II / operating subsidiariesof Ergon Capital Partners III (ECP)ECP’s contribution to GBL’s net earnings as of 31 Decem<strong>be</strong>r<strong>2011</strong> amounted to EUR - 11 million, compared to EUR 12million a year earlier. This variation stems principally from theevolution of the book values of its portfolio.C.2. Earnings on disposals, impairments and reversals fromnon-current assetsEarnings on disposals, impairments and reversals from noncurrentassets essentially include net capital gains (EUR 36 million)on the disposal of various PAI Europe III and Sagard assets.D. Eliminations, capital gains, impairments and reversalsIn EUR million <strong>2011</strong> 2010Impairment on associated companies (649.6) -Impairment on listed assets available for sale (AFS) - (20.4)Eliminations of dividends (111.6) (144.0)Capital gains on disposals 10.6 -Total (750.6) (164.4)Impairments on associated companiesIn compliance with IAS 28 (Investments in associates) andIAS 36 (Impairment of assets), an impairment test must <strong>be</strong>performed on the consolidated book value of an investmentin the event of a significant or prolonged decrease in its shareprice. In this context, GBL compared the value of the stake inLafarge in the consolidated accounts with the value in use andthe year-end stock market value. Value in use is defined as thepresent value of expected future cash flows (Discounted CashFlow).This method has <strong>be</strong>en applied consistently since 2008 andresulted in an impairment of EUR 1,092 million in 2008,reversed in 2009 in the amount of EUR 650 million.Reiteration of this impairment test on 30 Septem<strong>be</strong>r <strong>2011</strong>,based on information available as of that date and taking intoaccount the weakened economic environment, resulted in aconsolidated book value (EUR 65.2 per share) greater than thevalue in use. GBL consequently entered an impairment thathad the effect of lowering this value to the share in Lafarge’sIFRS equity at the end of Septem<strong>be</strong>r <strong>2011</strong> (EUR 54.4 pershare), which falls within the range of estimated values in use.This impairment of EUR 10.8 per share represented a chargeof EUR 650 million for <strong>2011</strong>’s third quarter.The impairment test was repeated on 31 Decem<strong>be</strong>r <strong>2011</strong>but did not result in any change to the conclusions of the30 Septem<strong>be</strong>r <strong>2011</strong> test. As a result, the consolidated bookvalue of Lafarge in GBL still corresponds to Lafarge’s IFRSshareholders’ equity at the end of <strong>2011</strong>, i.e. EUR 55.8 pershare.Eliminations of dividendsNet dividends on operating investments (associated orconsolidated companies) are eliminated. They representedEUR 112 million on the Lafarge and Imerys investments.Capital gains on disposalsIn <strong>2011</strong>, GBL disposed of part of its investment in I<strong>be</strong>rdrola at asale price of over EUR 90 million, resulting in a capital gain ondisposals of EUR 11 million. GBL still owned 0.2% of I<strong>be</strong>rdrolaas of 31 Decem<strong>be</strong>r <strong>2011</strong>.18 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>