Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

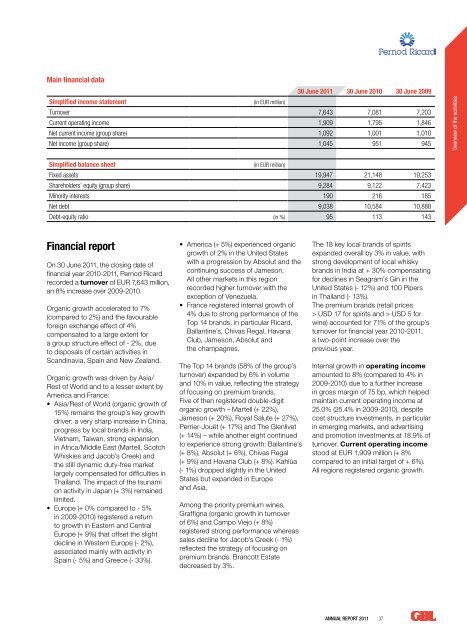

Main financial data30 June <strong>2011</strong> 30 June 2010 30 June 2009Simplified income statement(in EUR million)Turnover 7,643 7,081 7,203Current operating income 1,909 1,795 1,846Net current income (group share) 1,092 1,001 1,010Net income (group share) 1,045 951 945Overview of the activitiesSimplified balance sheet(in EUR million)Fixed assets 19,947 21,148 19,253Shareholders’ equity (group share) 9,284 9,122 7,423Minority interests 190 216 185Net debt 9,038 10,584 10,888Debt-equity ratio (in %) 95 113 143Financial reportOn 30 June <strong>2011</strong>, the closing date offinancial year 2010-<strong>2011</strong>, Pernod Ricardrecorded a turnover of EUR 7,643 million,an 8% increase over 2009-2010.Organic growth accelerated to 7%(compared to 2%) and the favourableforeign exchange effect of 4%compensated to a large extent fora group structure effect of - 2%, dueto disposals of certain activities inScandinavia, Spain and New Zealand.Organic growth was driven by Asia/Rest of World and to a lesser extent byAmerica and France:• Asia/Rest of World (organic growth of15%) remains the group’s key growthdriver: a very sharp increase in China,progress by local brands in India,Vietnam, Taiwan, strong expansionin Africa/Middle East (Martell, ScotchWhiskies and Jacob’s Creek) andthe still dynamic duty-free marketlargely compensated for difficulties inThailand. The impact of the tsunamion activity in Japan (+ 3%) remainedlimited.• Europe (+ 0% compared to - 5%in 2009-2010) registered a returnto growth in Eastern and CentralEurope (+ 9%) that offset the slightdecline in Western Europe (- 2%),associated mainly with activity inSpain (- 5%) and Greece (- 33%).• America (+ 5%) experienced organicgrowth of 2% in the United Stateswith a progression by Absolut and thecontinuing success of Jameson.All other markets in this regionrecorded higher turnover with theexception of Venezuela.• France registered internal growth of4% due to strong performance of theTop 14 brands, in particular Ricard,Ballantine’s, Chivas Regal, HavanaClub, Jameson, Absolut andthe champagnes.The Top 14 brands (58% of the group’sturnover) expanded by 6% in volumeand 10% in value, reflecting the strategyof focusing on premium brands.Five of then registered double-digitorganic growth – Martell (+ 22%),Jameson (+ 20%), Royal Salute (+ 27%),Perrier-Jouët (+ 17%) and The Glenlivet(+ 14%) – while another eight continuedto experience strong growth: Ballantine’s(+ 8%), Absolut (+ 6%), Chivas Regal(+ 9%) and Havana Club (+ 8%). Kahlúa(- 1%) dropped slightly in the UnitedStates but expanded in Europeand Asia.Among the priority premium wines,Graffigna (organic growth in turnoverof 6%) and Campo Viejo (+ 8%)registered strong performance whereassales decline for Jacob’s Creek (- 1%)reflected the strategy of focusing onpremium brands. Brancott Estatedecreased by 3%.The 18 key local brands of spiritsexpanded overall by 3% in value, withstrong development of local whiskybrands in India at + 30% compensatingfor declines in Seagram’s Gin in theUnited States (- 12%) and 100 Pipersin Thailand (- 13%).The premium brands (retail prices> USD 17 for spirits and > USD 5 forwine) accounted for 71% of the group’sturnover for financial year 2010-<strong>2011</strong>,a two-point increase over theprevious year.Internal growth in operating incomeamounted to 8% (compared to 4% in2009-2010) due to a further increasein gross margin of 75 bp, which helpedmaintain current operating income at25.0% (25.4% in 2009-2010), despitecost structure investments, in particularin emerging markets, and advertisingand promotion investments at 18.9% ofturnover. Current operating incomestood at EUR 1,909 million (+ 8%compared to an initial target of + 6%).All regions registered organic growth.<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 37