Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

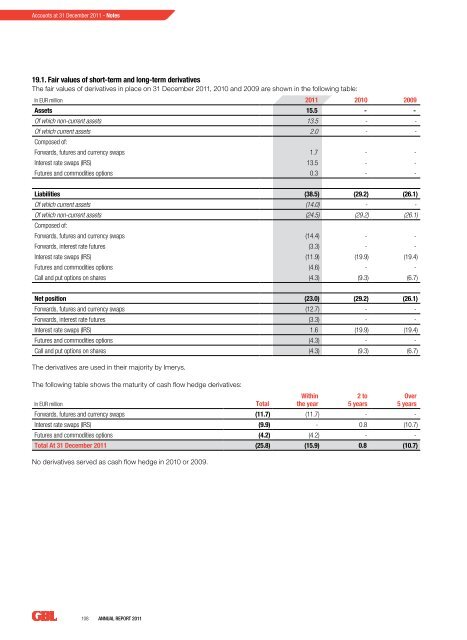

Accounts at 31 Decem<strong>be</strong>r <strong>2011</strong> - Notes19.1. Fair values of short-term and long-term derivativesThe fair values of derivatives in place on 31 Decem<strong>be</strong>r <strong>2011</strong>, 2010 and 2009 are shown in the following table:In EUR million <strong>2011</strong> 2010 2009Assets 15.5 - -Of which non-current assets 13.5 - -Of which current assets 2.0 - -Composed of:Forwards, futures and currency swaps 1.7 - -Interest rate swaps (IRS) 13.5 - -Futures and commodities options 0.3 - -Liabilities (38.5) (29.2) (26.1)Of which current assets (14.0) - -Of which non-current assets (24.5) (29.2) (26.1)Composed of:Forwards, futures and currency swaps (14.4) - -Forwards, interest rate futures (3.3) - -Interest rate swaps (IRS) (11.9) (19.9) (19.4)Futures and commodities options (4.6) - -Call and put options on shares (4.3) (9.3) (6.7)Net position (23.0) (29.2) (26.1)Forwards, futures and currency swaps (12.7) - -Forwards, interest rate futures (3.3) - -Interest rate swaps (IRS) 1.6 (19.9) (19.4)Futures and commodities options (4.3) - -Call and put options on shares (4.3) (9.3) (6.7)The derivatives are used in their majority by Imerys.The following table shows the maturity of cash flow hedge derivatives:In EUR millionTotalWithinthe year2 to5 yearsOver5 yearsForwards, futures and currency swaps (11.7) (11.7) - -Interest rate swaps (IRS) (9.9) - 0.8 (10.7)Futures and commodities options (4.2) (4.2) - -Total At 31 Decem<strong>be</strong>r <strong>2011</strong> (25.8) (15.9) 0.8 (10.7)No derivatives served as cash flow hedge in 2010 or 2009.108 <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong>