Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

Annual Report 2011 - Analist.be

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

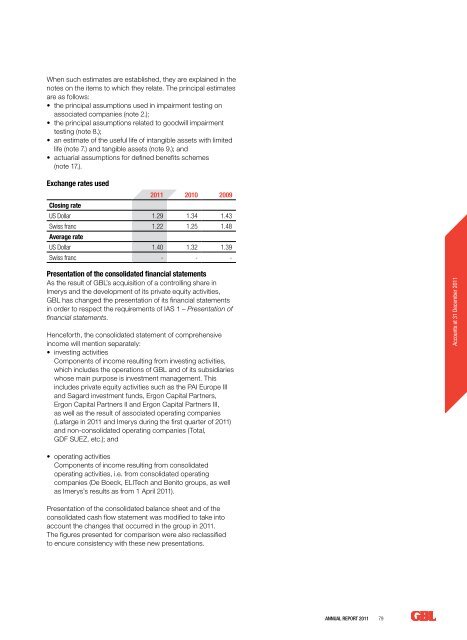

When such estimates are established, they are explained in thenotes on the items to which they relate. The principal estimatesare as follows:• the principal assumptions used in impairment testing onassociated companies (note 2.);• the principal assumptions related to goodwill impairmenttesting (note 8.);• an estimate of the useful life of intangible assets with limitedlife (note 7.) and tangible assets (note 9.); and• actuarial assumptions for defined <strong>be</strong>nefits schemes(note 17.).Exchange rates used<strong>2011</strong> 2010 2009Closing rateUS Dollar 1.29 1.34 1.43Swiss franc 1.22 1.25 1.48Average rateUS Dollar 1.40 1.32 1.39Swiss franc - - -Presentation of the consolidated financial statementsAs the result of GBL’s acquisition of a controlling share inImerys and the development of its private equity activities,GBL has changed the presentation of its financial statementsin order to respect the requirements of IAS 1 – Presentation offinancial statements.Henceforth, the consolidated statement of comprehensiveincome will mention separately:• investing activitiesComponents of income resulting from investing activities,which includes the operations of GBL and of its subsidiarieswhose main purpose is investment management. Thisincludes private equity activities such as the PAI Europe IIIand Sagard investment funds, Ergon Capital Partners,Ergon Capital Partners II and Ergon Capital Partners III,as well as the result of associated operating companies(Lafarge in <strong>2011</strong> and Imerys during the first quarter of <strong>2011</strong>)and non-consolidated operating companies (Total,GDF SUEZ, etc.); andAccounts at 31 Decem<strong>be</strong>r <strong>2011</strong>• operating activitiesComponents of income resulting from consolidatedoperating activities, i.e. from consolidated operatingcompanies (De Boeck, ELITech and Benito groups, as wellas Imerys’s results as from 1 April <strong>2011</strong>).Presentation of the consolidated balance sheet and of theconsolidated cash flow statement was modified to take intoaccount the changes that occurred in the group in <strong>2011</strong>.The figures presented for comparison were also reclassifiedto encure consistency with these new presentations.<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 79