Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

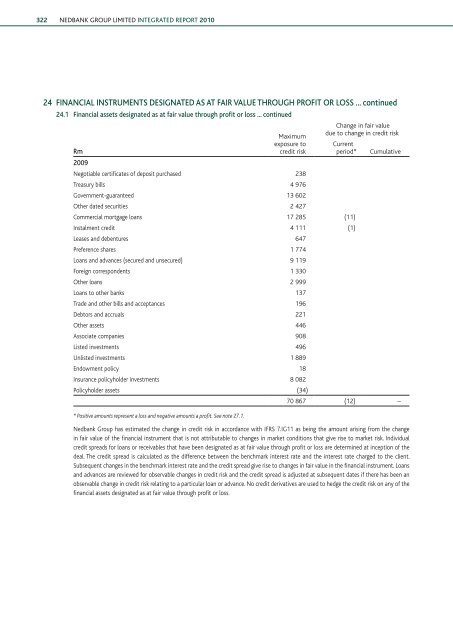

322 NEDBANK GROUP <strong>Limited</strong> INTEGRATED REPORT 201024 FINANCIAL INSTRUMENTS DESIGNATED AS AT FAIR VALUE THROUGH PROFIT OR LOSS ... continued24.1 Financial assets designated as at fair value through profit or loss ... continuedRm2009Maximumexposure tocredit riskNegotiable certificates of deposit purchased 238Treasury bills 4 976Government-guaranteed 13 602O<strong>the</strong>r dated securities 2 427Change in fair valuedue to change in credit riskCurrentperiod*Commercial mortgage loans 17 285 (11)Instalment credit 4 111 (1)Leases and debentures 647Preference shares 1 774Loans and advances (secured and unsecured) 9 119Foreign correspondents 1 330O<strong>the</strong>r loans 2 999Loans to o<strong>the</strong>r banks 137Trade and o<strong>the</strong>r bills and acceptances 196Debtors and accruals 221O<strong>the</strong>r assets 446Associate companies 908Listed investments 496Unlisted investments 1 889Endowment policy 18Insurance policyholder investments 8 082Policyholder assets (34)* Positive amounts represent a loss and negative amounts a profit. See note 27.1.Cumulative70 867 (12) –<strong>Nedbank</strong> <strong>Group</strong> has estimated <strong>the</strong> change in credit risk in accordance with IFRS 7.IG11 as being <strong>the</strong> amount arising from <strong>the</strong> changein fair value of <strong>the</strong> financial instrument that is not attributable to changes in market conditions that give rise to market risk. Individualcredit spreads for loans or receivables that have been designated as at fair value through profit or loss are determined at inception of <strong>the</strong>deal. The credit spread is calculated as <strong>the</strong> difference between <strong>the</strong> benchmark interest rate and <strong>the</strong> interest rate charged to <strong>the</strong> client.Subsequent changes in <strong>the</strong> benchmark interest rate and <strong>the</strong> credit spread give rise to changes in fair value in <strong>the</strong> financial instrument. Loansand advances are reviewed for observable changes in credit risk and <strong>the</strong> credit spread is adjusted at subsequent dates if <strong>the</strong>re has been anobservable change in credit risk relating to a particular loan or advance. No credit derivatives are used to hedge <strong>the</strong> credit risk on any of <strong>the</strong>financial assets designated as at fair value through profit or loss.