Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

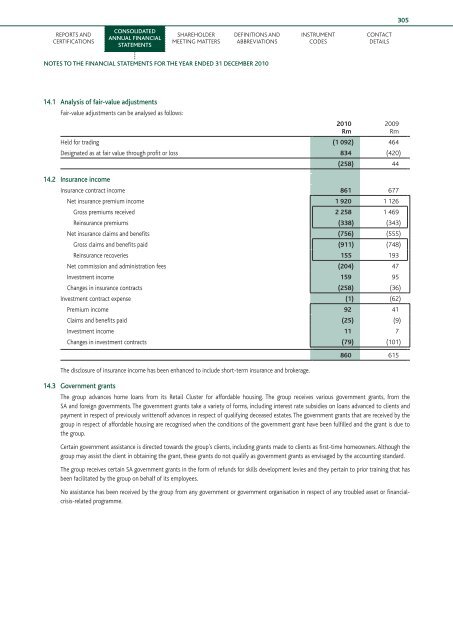

305Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsnotes to <strong>the</strong> financial statements for <strong>the</strong> year ended 31 December 201014.1 Analysis of fair-value adjustmentsFair-value adjustments can be analysed as follows:Held for trading (1 092) 464Designated as at fair value through profit or loss 834 (420)14.2 Insurance income2010Rm2009Rm(258) 44Insurance contract income 861 677Net insurance premium income 1 920 1 126Gross premiums received 2 258 1 469Reinsurance premiums (338) (343)Net insurance claims and benefits (756) (555)Gross claims and benefits paid (911) (748)Reinsurance recoveries 155 193Net commission and administration fees (204) 47Investment income 159 95Changes in insurance contracts (258) (36)Investment contract expense (1) (62)Premium income 92 41Claims and benefits paid (25) (9)Investment income 11 7Changes in investment contracts (79) (101)The disclosure of insurance income has been enhanced to include short-term insurance and brokerage.14.3 Government grants860 615The group advances home loans from its Retail Cluster for affordable housing. The group receives various government grants, from <strong>the</strong>SA and foreign governments. The government grants take a variety of forms, including interest rate subsidies on loans advanced to clients andpayment in respect of previously writtenoff advances in respect of qualifying deceased estates. The government grants that are received by <strong>the</strong>group in respect of affordable housing are recognised when <strong>the</strong> conditions of <strong>the</strong> government grant have been fulfilled and <strong>the</strong> grant is due to<strong>the</strong> group.Certain government assistance is directed towards <strong>the</strong> group’s clients, including grants made to clients as first-time homeowners. Although <strong>the</strong>group may assist <strong>the</strong> client in obtaining <strong>the</strong> grant, <strong>the</strong>se grants do not qualify as government grants as envisaged by <strong>the</strong> accounting standard.The group receives certain SA government grants in <strong>the</strong> form of refunds for skills development levies and <strong>the</strong>y pertain to prior training that hasbeen facilitated by <strong>the</strong> group on behalf of its employees.No assistance has been received by <strong>the</strong> group from any government or government organisation in respect of any troubled asset or financialcrisis-relatedprogramme.