Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

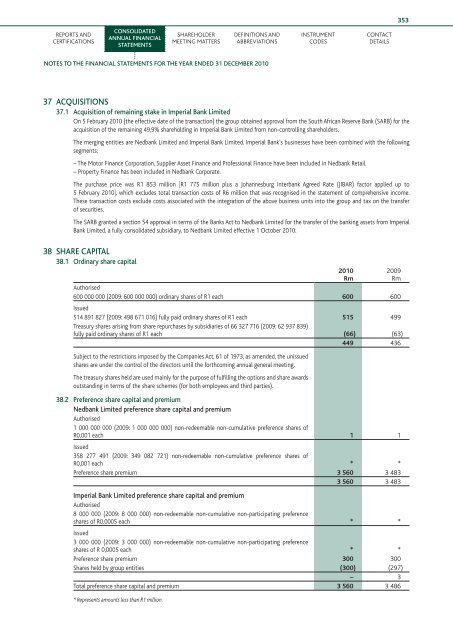

353Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsnotes to <strong>the</strong> financial statements for <strong>the</strong> year ended 31 December 201037 ACQUISITIONS37.1 Acquisition of remaining stake in Imperial Bank <strong>Limited</strong>On 5 February 2010 (<strong>the</strong> effective date of <strong>the</strong> transaction) <strong>the</strong> group obtained approval from <strong>the</strong> South African Reserve Bank (SARB) for <strong>the</strong>acquisition of <strong>the</strong> remaining 49,9% shareholding in Imperial Bank <strong>Limited</strong> from non-controlling shareholders.The merging entities are <strong>Nedbank</strong> <strong>Limited</strong> and Imperial Bank <strong>Limited</strong>. Imperial Bank’s businesses have been combined with <strong>the</strong> followingsegments:– The Motor Finance Corporation, Supplier Asset Finance and Professional Finance have been included in <strong>Nedbank</strong> Retail.– Property Finance has been included in <strong>Nedbank</strong> Corporate.The purchase price was R1 853 million [R1 775 million plus a Johannesburg Interbank Agreed Rate (JIBAR) factor applied up to5 February 2010], which excludes total transaction costs of R6 million that was recognised in <strong>the</strong> statement of comprehensive income.These transaction costs exclude costs associated with <strong>the</strong> integration of <strong>the</strong> above business units into <strong>the</strong> group and tax on <strong>the</strong> transferof securities.The SARB granted a section 54 approval in terms of <strong>the</strong> Banks Act to <strong>Nedbank</strong> <strong>Limited</strong> for <strong>the</strong> transfer of <strong>the</strong> banking assets from ImperialBank <strong>Limited</strong>, a fully consolidated subsidiary, to <strong>Nedbank</strong> <strong>Limited</strong> effective 1 October 2010.38 SHARE CAPITAL38.1 Ordinary share capitalAuthorised600 000 000 (2009: 600 000 000) ordinary shares of R1 each 600 600Issued514 891 827 (2009: 498 671 016) fully paid ordinary shares of R1 each 515 499Treasury shares arising from share repurchases by subsidiaries of 66 327 716 (2009: 62 937 839)fully paid ordinary shares of R1 each (66) (63)449 436Subject to <strong>the</strong> restrictions imposed by <strong>the</strong> Companies Act, 61 of 1973, as amended, <strong>the</strong> unissuedshares are under <strong>the</strong> control of <strong>the</strong> directors until <strong>the</strong> forthcoming annual general meeting.The treasury shares held are used mainly for <strong>the</strong> purpose of fulfilling <strong>the</strong> options and share awardsoutstanding in terms of <strong>the</strong> share schemes (for both employees and third parties).38.2 Preference share capital and premium<strong>Nedbank</strong> <strong>Limited</strong> preference share capital and premiumAuthorised1 000 000 000 (2009: 1 000 000 000) non-redeemable non-cumulative preference shares ofR0,001 each 1 1Issued358 277 491 (2009: 349 082 721) non-redeemable non-cumulative preference shares ofR0,001 each * *Preference share premium 3 560 3 4833 560 3 483Imperial Bank <strong>Limited</strong> preference share capital and premiumAuthorised8 000 000 (2009: 8 000 000) non-redeemable non-cumulative non-participating preferenceshares of R0,0005 each * *Issued3 000 000 (2009: 3 000 000) non-redeemable non-cumulative non-participating preferenceshares of R 0,0005 each * *Preference share premium 300 300Shares held by group entities (300) (297)– 3Total preference share capital and premium 3 560 3 486* Represents amounts less than R1 million.2010Rm2009Rm