Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Download the PDF (5.4 MB) - Nedbank Group Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

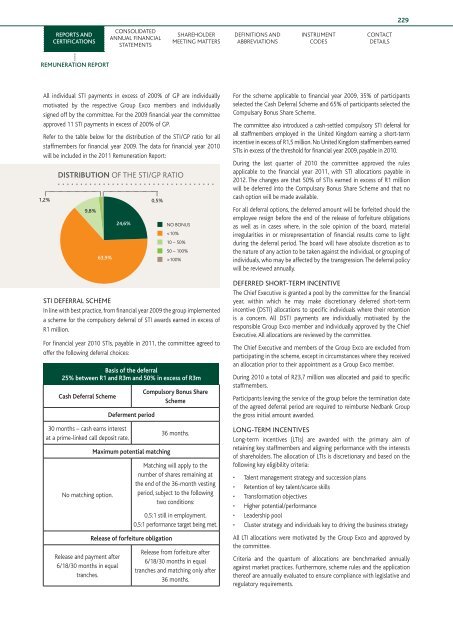

229Reports andcertificationsConsolidatedannual financialstatementsShareholdermeeting mattersDefinitions andabbreviationsInstrumentcodesContactdetailsremuneration reportAll individual STI payments in excess of 200% of GP are individuallymotivated by <strong>the</strong> respective <strong>Group</strong> Exco members and individuallysigned off by <strong>the</strong> committee. For <strong>the</strong> 2009 financial year <strong>the</strong> committeeapproved 11 STI payments in excess of 200% of GP.Refer to <strong>the</strong> table below for <strong>the</strong> distribution of <strong>the</strong> STI/GP ratio for allstaffmembers for financial year 2009. The data for financial year 2010will be included in <strong>the</strong> 2011 Remuneration Report:1,2%distribution of <strong>the</strong> STI/gp ratio9,8%63,9%STI Deferral SchemeIn line with best practice, from financial year 2009 <strong>the</strong> group implementeda scheme for <strong>the</strong> compulsory deferral of STI awards earned in excess ofR1 million.For financial year 2010 STIs, payable in 2011, <strong>the</strong> committee agreed tooffer <strong>the</strong> following deferral choices:Basis of <strong>the</strong> deferral25% between R1 and R3m and 50% in excess of R3mCash Deferral Scheme30 months – cash earns interestat a prime-linked call deposit rate.No matching option.Release and payment after6/18/30 months in equaltranches.24,6%Deferment period0,5%Maximum potential matchingRelease of forfeiture obligationno bonus100%Compulsory Bonus ShareScheme36 months.Matching will apply to <strong>the</strong>number of shares remaining at<strong>the</strong> end of <strong>the</strong> 36-month vestingperiod, subject to <strong>the</strong> followingtwo conditions:0,5:1 still in employment.0,5:1 performance target being met.Release from forfeiture after6/18/30 months in equaltranches and matching only after36 months.For <strong>the</strong> scheme applicable to financial year 2009, 35% of participantsselected <strong>the</strong> Cash Deferral Scheme and 65% of participants selected <strong>the</strong>Compulsary Bonus Share Scheme.The committee also introduced a cash-settled compulsory STI deferral forall staffmembers employed in <strong>the</strong> United Kingdom earning a short-termincentive in excess of R1,5 million. No United Kingdom staffmembers earnedSTIs in excess of <strong>the</strong> threshold for financial year 2009, payable in 2010.During <strong>the</strong> last quarter of 2010 <strong>the</strong> committee approved <strong>the</strong> rulesapplicable to <strong>the</strong> financial year 2011, with STI allocations payable in2012. The changes are that 50% of STIs earned in excess of R1 millionwill be deferred into <strong>the</strong> Compulsary Bonus Share Scheme and that nocash option will be made available.For all deferral options, <strong>the</strong> deferred amount will be forfeited should <strong>the</strong>employee resign before <strong>the</strong> end of <strong>the</strong> release of forfeiture obligationsas well as in cases where, in <strong>the</strong> sole opinion of <strong>the</strong> board, materialirregularities in or misrepresentation of financial results come to lightduring <strong>the</strong> deferral period. The board will have absolute discretion as to<strong>the</strong> nature of any action to be taken against <strong>the</strong> individual, or grouping ofindividuals, who may be affected by <strong>the</strong> transgression. The deferral policywill be reviewed annually.Deferred short-term incentiveThe Chief Executive is granted a pool by <strong>the</strong> committee for <strong>the</strong> financialyear, within which he may make discretionary deferred short-termincentive (DSTI) allocations to specific individuals where <strong>the</strong>ir retentionis a concern. All DSTI payments are individually motivated by <strong>the</strong>responsible <strong>Group</strong> Exco member and individually approved by <strong>the</strong> ChiefExecutive. All allocations are reviewed by <strong>the</strong> committee.The Chief Executive and members of <strong>the</strong> <strong>Group</strong> Exco are excluded fromparticipating in <strong>the</strong> scheme, except in circumstances where <strong>the</strong>y receivedan allocation prior to <strong>the</strong>ir appointment as a <strong>Group</strong> Exco member.During 2010 a total of R23,7 million was allocated and paid to specificstaffmembers.Participants leaving <strong>the</strong> service of <strong>the</strong> group before <strong>the</strong> termination dateof <strong>the</strong> agreed deferral period are required to reimburse <strong>Nedbank</strong> <strong>Group</strong><strong>the</strong> gross initial amount awarded.Long-term incentivesLong-term incentives (LTIs) are awarded with <strong>the</strong> primary aim ofretaining key staffmembers and aligning performance with <strong>the</strong> interestsof shareholders. The allocation of LTIs is discretionary and based on <strong>the</strong>following key eligibility criteria:• Talent management strategy and succession plans• Retention of key talent/scarce skills• Transformation objectives• Higher potential/performance• Leadership pool• Cluster strategy and individuals key to driving <strong>the</strong> business strategyAll LTI allocations were motivated by <strong>the</strong> <strong>Group</strong> Exco and approved by<strong>the</strong> committee.Criteria and <strong>the</strong> quantum of allocations are benchmarked annuallyagainst market practices. Fur<strong>the</strong>rmore, scheme rules and <strong>the</strong> application<strong>the</strong>reof are annually evaluated to ensure compliance with legislative andregulatory requirements.